This is why everyone wants a piece of the 5G pie

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

Headlines about the global “5G Race” are everywhere these days. We were told that China and South Korea jumped out to a big lead in 2018, but the US is now surging to the front of the pack. But is 5G really such a big deal? Is it really worth a cutthroat worldwide race?

In two words, yes and yes. Here’s why.

For starters, what is 5G?

The G in 3G, 4G and 5G stands for “generation”. When there is talk about 5G, often the general reaction is, “Oh, it’s just faster internet.” But to qualify as a new generation, a cellular network can’t just be faster. It has to set a whole new standard for reliability and connectivity.

So yes, a big boost in internet speed is definitely included in the package of benefits, but 5G is much more groundbreaking than that. If they deliver on the promises, 5G networks will connect the world in ways most of us have never imagined.

To see just how much a jump in generation can change things, let’s go on a quick trip down memory lane:

- With 2G, we were able to send each other text messages, and that was about it.

- At 3G, we were able to start using internet and data on our devices. (Surely some of you remember how incredible we thought that was back then.)

- Then came 4G – what we have now. This made our network experience a whole lot faster and a whole lot better. Streaming music and videos went from hassle to thing, map and GPS apps actually worked, and much more.

The issue now is that 4G networks are pretty much at their capacity. With the rise of the Internet of Things (IoT), almost everything in your daily life, from your (soon self-driving) car to your toaster, will probably have internet flowing through it very soon.

In fact, Cisco predicts that 50 billion smart devices will soon connect to mobile networks, causing a tenfold increase in the use of mobile data in the next few years. Great as it is, 4G just can’t accommodate that influx.

This is where 5G comes in, the mega-fast, mega-capacity dream that every major country and tech company is chasing. The new network will have the juice to act as the backbone of our future tech reality. That is, if someone can prove they know how to make it work.

That means a huge payoff for the race winner – the first team to implement a large, working 5G network for civilians. But that’s just part of the story. Even before 5G is up and running, economies can claim huge prizes just by developing the technology and network infrastructure.

[article_ad]

Economic benefits during the 5G rollout phase

At a July DBS Banking event in Hong Kong, Head of Consumer Banking and Wealth Management Sim Lim discussed various trends and opportunities across the globe. He ended a section of his presentation focused on the US and Chinese markets by saying,

A winning economy would be the country that leads the 5G technology race.

So basically, just leading the race puts an economy on top, even if that economy doesn’t ultimately cross the finish line first. That’s because the huge economic benefits of 5G development are already experienced during the rollout phase, by both businesses and governments

How businesses benefit from 5G rollout activities

Patents and royalties

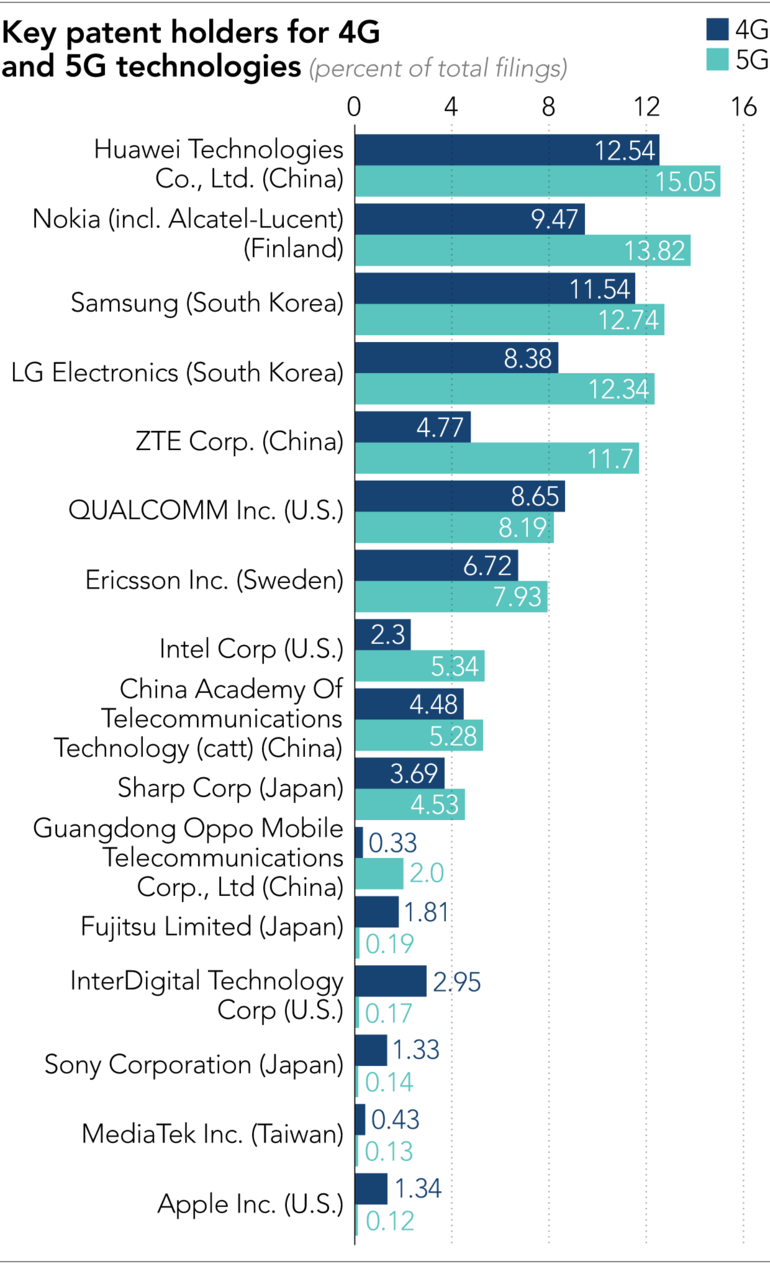

Because companies are pouring huge investments into 5G research, for each step into uncharted R&D territory, there is a need to protect the discoveries. This is where patents come in. For example, as of January 2019, Apple held nine patents on millimeter wave technology – the technology that will facilitate 5G communication between devices.

Some of these patents probably won’t hold much value – other developers might come up with workarounds to avoid using the technology. But anytime a discovery proves essential to 5G functionality, every company that wishes to incorporate that technology into its own products will have to pay Apple a fee, called a royalty.

For smartphones, royalty fees for a single patent tend to be about 2% of the product cost. If that doesn’t sound like much, keep in mind that companies like Apple deal in billions of dollars. And 2% of $1 billion just happens to be a cool $20 million. When multiple patents are involved, the money adds up fast.

Over the last two decades, competition for patent ownership in the mobile industry has grown increasingly fierce. Companies try to accumulate patents, otherwise known as “royalty stacking”, making it economically impractical for any other company to put a similar product on the market.

Researchers have estimated that patent royalties can exceed $120 on a $400 smartphone. That means about 30% of what you pay for the phone is going to the companies that hold the patents, not the one that made the device. That’s a steep price to pay for any new company hoping to enter the market.

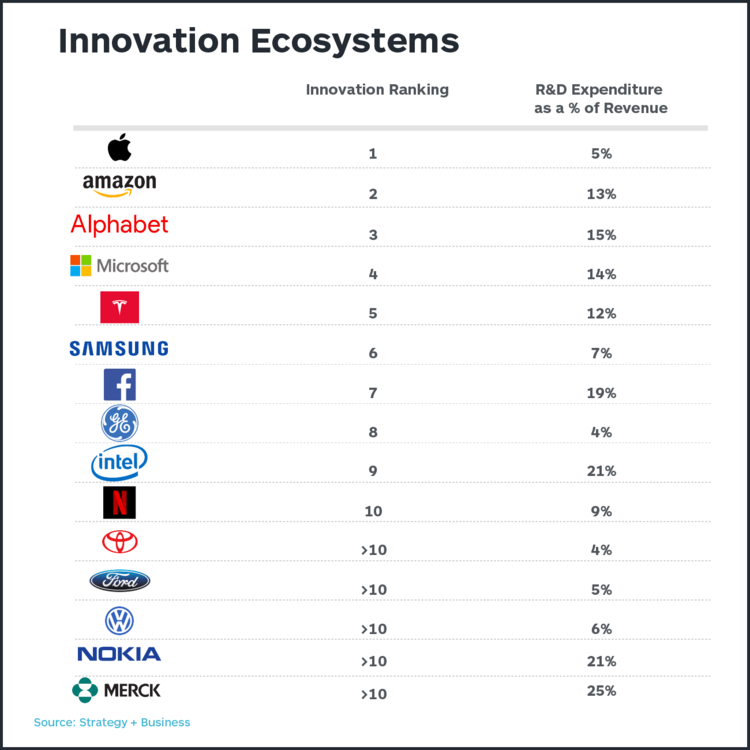

Surprisingly, the business strategy firm Pricewaterhouse Coopers (PwC) has shown that there is no clear correlation between a company’s R&D spending and its level of innovation. But that definitely doesn’t stop businesses from trying. Amazon, for example, spends 13% of its revenue on R&D and is ranked #2 globally for innovation. Apple, on the other hand, claims the #1 ranking for innovation while spending just about 5% of its revenue on R&D.

Aside from the ability to collect royalties, holding patents also gives companies greater bargaining power when it comes to negotiating cross-licensing agreements with competitors. A cross-licensing agreement allows two companies to use each others’ patented technology, either free of charge or at reduced royalty rates.

Examples of cross-licensing agreements, and how much they matter

Apple and Microsoft have an ongoing cross-licensing agreement that dates back to the 1990s, covering patents on technical software features. The agreement allows both companies to push technology forward faster and more cheaply than many of their competitors.

Meanwhile, Google and some of its major partners have created PAX, where members are able to provide and access any developments related to the Android platform, royalty free. Again, the system gives members a huge leg up on other tech companies on the outside looking in.

In short, patents are power, and in a hot field like 5G, that power means money and lots of it.

5G rollout benefits for governments and economies

Spectrum Licenses

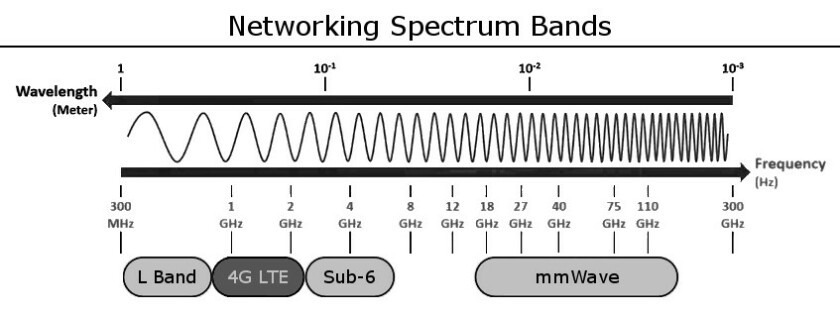

Devices communicate with one another through radio waves, the same type of waves used by air traffic control centers, militaries, and radio and TV stations. Radio waves have a wide range of frequencies, known as the frequency spectrum. Narrower frequency ranges within this broad spectrum, sometimes called bands, are dedicated for specific purposes.

Radio stations broadcast within a dedicated frequency band (actually two – one for AM and one for FM), and so do TV broadcasters. There’s also a band specifically allocated for 4G Wireless Service Providers (WSPs, also called mobile carriers). The 5G network uses an ultra-high frequency band, which offers a lot of advantages, including massive capacity, lower risk of interference, and greater energy efficiency.

Each time a new frequency band comes into use, companies must obtain a spectrum license from their country’s government in order to use radio waves within that band. Think of it as a permanent lease between mobile carriers and the government for the invisible air space that radio waves travel across.

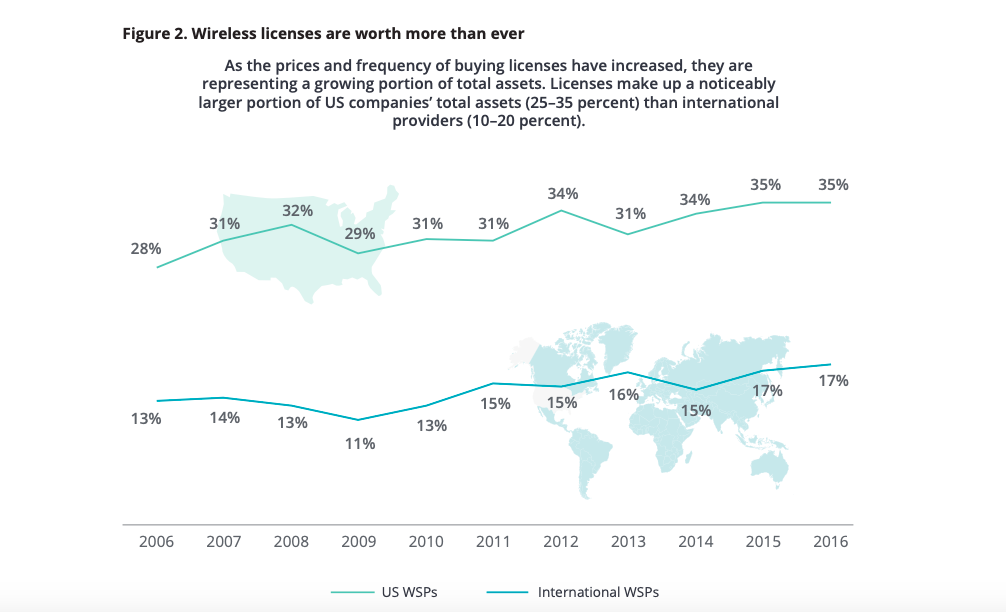

The US government sells spectrum licenses through regional auctions. Major mobile carriers like Verizon, T-Mobile and AT&T bid aggressively for the licenses, a process that can last up to several months.

The increasingly fierce competition for spectrum control – otherwise known as the “lifeblood” of the wireless industry – naturally drives up the cost of licenses. A few auctions can raise billions of dollars for the government.

As a result, according to a study by Deloitte, spectrum licenses accounted for up to 25%-35% of US mobile carriers’ assets in 2016. And although these licenses only amount to 10%-20% of the assets of international carriers, the percentage is rising for them, too.

Employment

Getting 5G up and running is an enormous undertaking that will create thousands or even millions of jobs for any economy participating in the race. Creating the software and hardware will require a range of engineers with diverse skills. And even though 5G towers are smaller than 4G towers, they still must be constructed, with components from a variety of suppliers.

A report released by Accenture predicts that in the US alone, the rollout period of 5G will involve a $275 billion infrastructure investment, creating up to 3 million jobs and adding $500 billion to the nation’s GDP.

Economic benefits for the 5G deployment race winners

While there are many benefits for just participating in the 5G tech race, some prizes can be claimed only by the company and country that first bring 5G to consumers on a wide scale.

A quick look at past wireless breakthroughs gives an idea of the magnitude of the winnings at stake for the economy that breaks the finish line tape.

Nokia made Finland a global economic player almost overnight.

Long before the dawn of 4G, there was a network called Global System for Mobile (GSM). This technology allowed mobile device users to make phone calls from anywhere in the world. That may not sound revolutionary now, but it sure was in 1992, when a Finnish company named Nokia unveiled GSM and vaulted to the forefront of the mobile industry.

With this invention, Nokia single-handedly transformed Finland’s economic fortunes and global significance. According to the Research Institute of the Finnish Economy (ETLA), Nokia accounted for a quarter of Finnish GDP growth from 1998 to 2007. Over that same period, Nokia was responsible for 30% of the country’s total investment in R&D, and paid as much as 23% of all Finnish corporate taxes.

4G leadership saved the US from major economic losses.

The US led the 4G race, resulting in nearly a $100 billion dollar increase in annual GDP. US 4G dominance significantly increased the economic value of the American wireless industry, which contributed $445 billion to the GDP in 2016.

Between the years 2011 and 2014, the number of wireless-related jobs in the US increased by 84%. More importantly, Recon Analytics estimates that if the US hadn’t dominated the 4G tech race, $125 billion in revenue would have been lost by American companies to the rest of the world.

Those are impressive numbers, but they only relate to the direct economic impacts of network deployment. Indirect impacts can be massive as well. With the arrival of 4G, for example, Apple created the App Store, which has brought in over $40 billion in revenue to US companies.

Considering all the possibilities for innovations that capitalize on the 5G platform, the winning country could experience a complete economic transformation, centered on entirely new industries.

In short, the BIG money will come from applications of 5G that we don’t even know about yet.

How big? Some analysts predict that IoT applications will add $14 trillion to the global economy by 2030. Now that is worth a race.

Bottom line

The economic implications of participating in and/or winning the 5G race make it abundantly clear why it’s such a hot topic, and why every major government wants a piece of the 5G action. And no one is stopping there. Despite the fact that 5G won’t be ready for everyone anytime soon, research time and money is already being poured into the development of 6G.

[article_ad]

Comments ()