How are China’s attempts at economic recovery different from other governments?

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

Economies across the word have taken a big hit during the COVID-19 crisis. According to the International Monetary Fund (IMF), most countries can expect their economies in 2021 to be at least 5% smaller than initially forecast, even if drastic recovery efforts are implemented.

Gita Gopinath, the IMF’s chief economist, says that next year is expected to be the worst year for the economy since the Great Depression of the 1930s, warning that losses would “dwarf” the global financial crisis of 2008.

In response, many countries are attempting to put in place policies they hope will mitigate disastrous effects on businesses and personal livelihoods.

Last month, the United States unveiled its largest relief package in history, and much of Europe and Asia have taken drastic steps at intervention as well.

Each country has taken a unique approach to economic relief. In Canada and the United States, increases in unemployment benefits and direct payments to citizens are underway to various degrees, while in Europe countries like Denmark and France are covering a large percentage of lost wages.

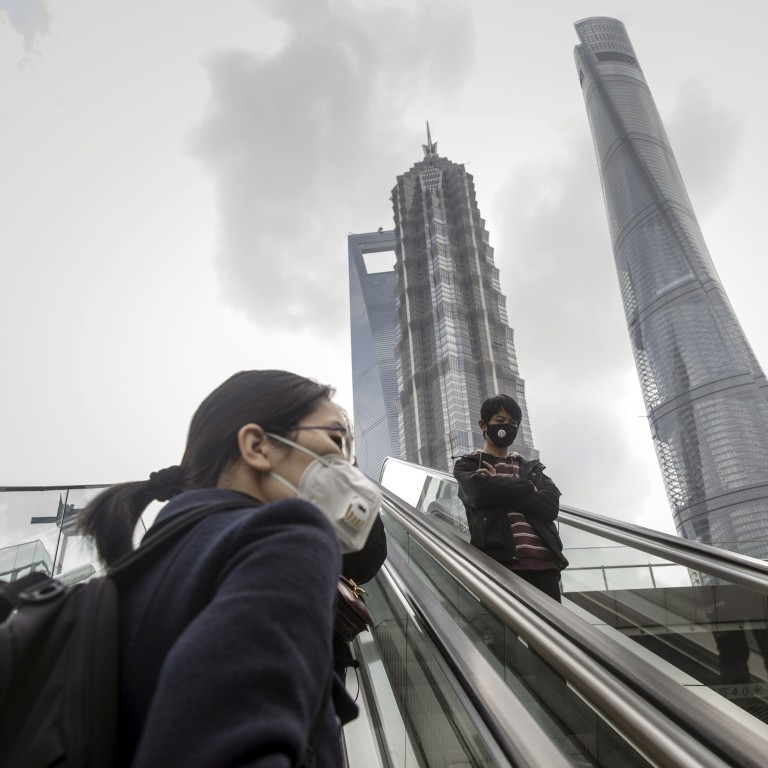

In China, economic stimulus efforts have been more muted. Despite China recording its first economic contraction since at least 1992, when quarterly GDP statistics were first introduced, Beijing decided to forgo direct relief to individuals. Instead, China has focused on keeping businesses solvent, which has allowed some employers to keep paying their workers.

Comparison to 2008 stimulus

On the heels of the 2008 global financial crisis, China implemented a sweeping stimulus package, one of the largest government responses at the time. Much of it was focused on infrastructure projects across the country, but it also covered low-income housing as well as innovation and investment projects designed to jumpstart the economy.

By contrast, in addition to keeping businesses afloat, this time Beijing has flooded more than US$1 trillion into its banking system, which has led to an all-time high in Chinese quarterly lending. Coupled with targeted interest rate cuts, Chinese officials claim that their approach will be more beneficial to the economy over the long term.

“Our internal assessment showed the amount [of liquidity injection] since January is overall appropriate and ample,” said Zhou Xuedong, a spokesman for the People’s Bank of China, the country’s central bank.

Is it going to be enough?

Despite the government’s confidence, other analysts worry that Beijing is not providing policy prescriptions in line with the nature of the crisis.

Lu Zhengwei, chief economist at the Industrial Bank in Shanghai, argues that COVID-19 presents a kind of economic shock that should be met with more people-centered measures.

“If you are focusing on investment, who is going to work? […] Investment stimulus plans won’t work well at the current stage, but could easily leave uncompleted projects,” he said. “It’s better to spend the money on people’s livelihoods.”

Although Beijing tried to keep wages flowing during the height of the lockdown, some businesses and workers struggled to get by. Restrictions on public movement and months-long shutdowns in the hardest hit areas led certain sectors, like hospitality and food and beverage, to sustain heavy losses.

While many Chinese businesses have begun reopening in light of the dwindling number of new coronavirus cases, China will now have to navigate a significantly-altered world economy, with many countries still in the midst of their own health crises. This has led some policy analysts in the country to call for more direct stimulus in the hands of regular citizens to keep demand flowing.

However, Justin Lin Yifu, an economist and adviser to the Chinese government, argues that direct cash payments might not be enough to stimulate the economy on their own.

“Consumption vouchers are more effective,” he said. “People may not consume cash when they get it, so it will not be directly converted into demand.”

China’s reopening

As many Chinese businesses and livelihoods are heavily connected to international supply chains, there are concerns that the hardships for Chinese citizens may not be over.

Nevertheless, observers say that since China has likely seen the worst of COVID-19, there is a possibility that the re-opening of China’s economy could eventually help restart the global economy.

According to a survey by the American Chamber of Commerce in China in late March, nearly a quarter of Chinese businesses expect a return to normal by the end of April.

Vinesh Motwani, the managing director of Silk Road Research, told the BBC that data tracked at his company indicates that most businesses in China will be back to 100% capacity by May, although demand is still likely to continue to lag for some time.

“Last month, my contacts in China said they weren’t going out, period. Now, they’re slowly going back to work – and even grabbing after-work beers,” he said.

[article_ad]

Have a tip or story? Get in touch with our reporters here!

Sign up for daily news briefs from The Millennial Source here!

Comments ()