As Huawei struggles, rivals pull ahead

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

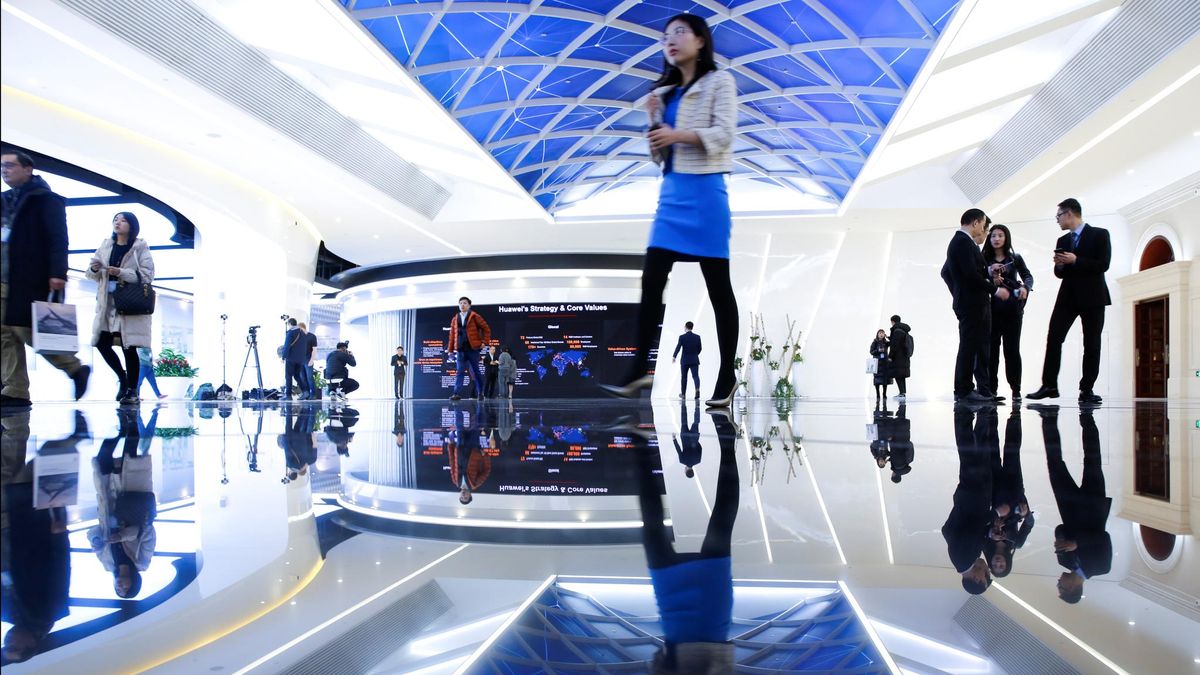

Huawei’s future remains under attack and its rivals have gained valuable time to build their global operations while their Chinese competitor remains frozen out of some of the world’s biggest markets.

2020 has not been kind to Huawei. The Chinese telecoms and 5G giant has faced targeted sanctions and restrictions, both on its services and its ability to acquire crucial components. Huawei has even seen itself become wrapped up in a geopolitical conflict along the Sino-Indian border.

In the face of all this, it is unsurprising that Huawei’s rivals have capitalized on its misfortune. Rival companies have secured billion-dollar deals and profited off of Huawei’s misery, all while the company itself faces the prospect of being locked out of multiple markets, including the world’s second-largest smartphone market in India, for the provision of its 5G infrastructure.

Despite the geopolitical and coronavirus-induced turmoil, Huawei can still enjoy some small triumphs. Its share of the smartphone market in the United States remains relatively unaffected, both by sanctions and the impact of the coronavirus. The company itself continues to grow and remains competitive against its rivals.

But the clouds hanging over Huawei do not appear to be clearing up anytime soon. A US sanction on technology sales to Huawei went into force on September 15, indicating that there may be hard times ahead for the Chinese company.

Huawei under fire

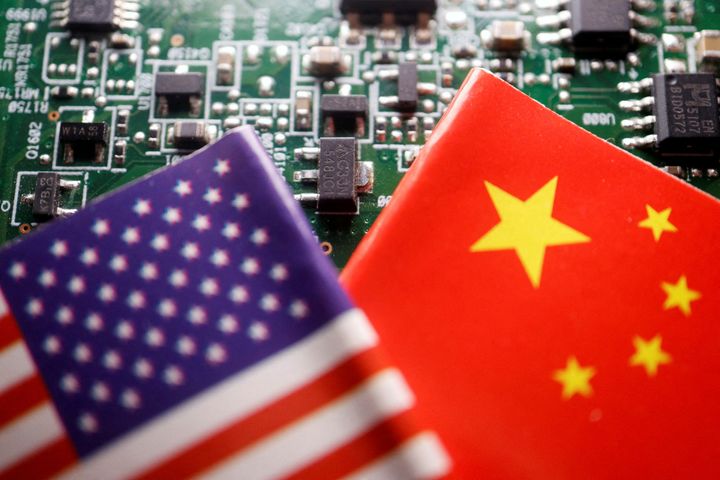

Huawei, alongside other Chinese companies, has been specifically targeted by the Trump administration as a national security threat.

The American government claims that Huawei installs “backdoors” into its network infrastructure that it has provided to countries around the world, allowing the Chinese government to infiltrate these systems and spy on the affected countries.

These accusations have already led to Huawei being banned from providing 5G infrastructure to several of America’s allies around the world, including the UK, which banned the use of Huawei’s technology in its 5G network in July.

Much of Huawei’s recent suffering comes from a May 2019 decision by the Trump Administration to place the Chinese company on the US Treasury Department’s “Entity List.” As a result, US firms were unable to sell technology to the company without US government approval, a restriction that was extended to 2021.

In May this year, Huawei also faced an amended export rule blocking shipments of semiconductors that used American technology. Semiconductors are crucial components in many electronics that underpin an array of modern devices. Huawei’s chief executive officer, Richard Yu, claimed in August that the company was running out of processing chips, impacting its ability to continue producing its line of smartphones.

Even with access to semiconductors, Huawei’s phones are becoming increasingly isolated and less attractive to consumers as a result. The restrictions placed on US companies dealing with Huawei has made it increasingly difficult for smartphones to receive Android updates or even access Google apps. As a result, Huawei has been forced to develop its own operating system, having been locked out of Google’s Android.

Huawei also faces the prospect of being frozen out of the world’s second-largest smartphone market and a growing market for 5G, India. Border clashes between India and China throughout 2020 have led to an “unofficial banning” of Huawei in the country, with Indian telecoms service providers being told not to use Huawei technology in the construction of 5G infrastructure in that country.

Accordingly, Huawei’s global phone shipments have declined over the last few months. Q1 and Q2 2020 saw Huawei ship some 104.8 million smartphones globally, a drop of some 13 million compared with Q1/2 2019.

Huawei’s rivals profit

Huawei’s rivals have capitalized on the numerous hits the company has taken in the last year.

In September, 5G-rival Samsung won a US$6.6 billion order to provide 5G wireless services to Verizon Communications Inc., the American telecoms provider.

The order was a significant coup for Samsung, making it one of the Korean company’s biggest orders to date and one that boosts its market share in the 5G wireless industry at a time when Huawei faces being frozen out of numerous regions.

In a further blow to Huawei, Samsung reportedly stopped the sale of components to Huawei following new US trade rules that came into force on September 15. Unable to secure semiconductor components from the US, Taiwan, or South Korea, China’s government has attempted to build up a domestic semiconductor provider, which is nonetheless now also facing potential sanctions.

In the rush to secure semiconductor components before vendors are cut off due to American sanctions, Huawei’s panic-buying has lined the pockets of Taiwanese producers.

In August, Taiwanese exports rose to a record level of US$31.2 billion, fueled in large part by demand from the likes of Huawei to secure crucial semiconductor parts while still available. Taiwan is one of the world’s largest semiconductor providers, with Huawei’s operations being severely impacted by any exclusion from this market.

Silver lining?

Despite the pain of sanctions, Huawei has some positive news it can take stock in.

For the first half of 2020, Huawei reported year-on-year revenue growth of some 13.1%, despite the impact of the coronavirus pandemic and American sanctions dating back to its placement on the US Treasury’s Entity List in May 2019.

The technology market analysts Canalys have also reported that Huawei’s global smartphone shipments for Q2 of 2020 have also improved, overtaking regional rival Samsung to claim the top spot worldwide. This is largely as a result of domestic Chinese demand, as China remains the world’s largest smartphone market and one that Huawei dominates.

The threat of sanctions has also yet to significantly damage Huawei’s share of the American smartphone market. In August 2019, several months into Huawei’s entity listing, its share of the US smartphone market stood at 1.05%. By August 2020, this figure had actually grown slightly, to stand at 1.1%.

Huawei’s hopes of a reversal of sanctions also received a boost with the knowledge that American suppliers would be equally impacted by a continuation of the current circumstances.

The American chipmaker Qualcomm has reportedly asked the Trump administration to ease restrictions on component sales to Huawei, which could signal a potential end to the mutually-destructive policy of hard-line sanctions.

Despite its growing revenues and continued market presence even in the US, Huawei’s future remains under attack and its rivals have gained valuable time to build their global operations while their Chinese competitor remains frozen out of some of the world’s biggest markets.

Have a tip or story? Get in touch with our reporters at tips@themilsource.com

Comments ()