Switzerland and Vietnam declared “currency manipulators” by the US

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

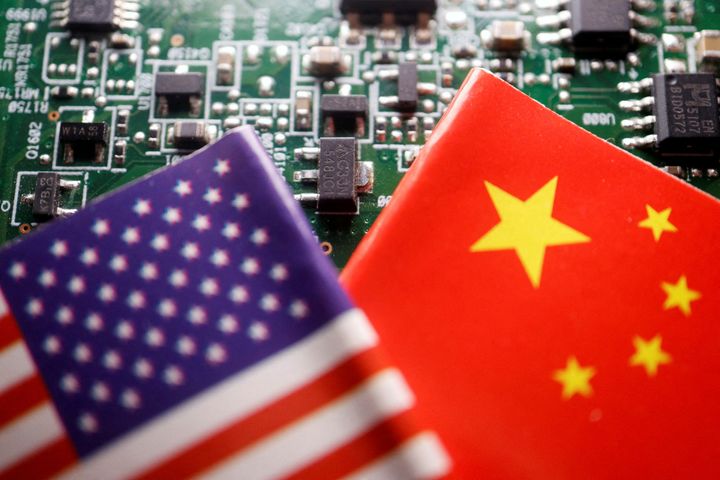

The designation adds yet another foreign policy conundrum for the incoming Biden administration to ponder, alongside the overarching and dominating issue of US-China relations.

The United States government recently declared Switzerland and Vietnam to be “currency manipulators,” a phrase that is not used lightly by the Treasury Department, nor those accused.

Currency manipulation can occur in a number of forms, but typically refers to interventions by national governments to shift the value of their currencies. For nations who trade internationally, a weaker currency can make exports cheaper and more attractive to foreign buyers.

This is not the first time the Trump administration has raised currency manipulation concerns. China was deemed a currency manipulator by the Treasury Department in 2019, before being removed in early-2020.

But to deem a nation a currency manipulator is a big step and one not often taken by the Treasury Department. In contrast, a number of nations are on the department’s currency manipulation “watchlist,” a step below being labeled a full currency manipulator.

Those on the watchlist include China (after its removal from full “currency manipulator” status), Japan, South Korea, Germany, Taiwan, Thailand and India.

For now, it is likely that Switzerland and Vietnam will engage in negotiations through the International Monetary Fund (IMF) to resolve the accusations made by the US, even as both countries have rejected the claims.

Currency manipulators

Currency manipulation can be beneficial for the trade practices of some nations.

A currency that is “weak,” that is, less valuable relative to other currencies, can serve to make the exports of a country more attractive on a competitive world market. Goods from countries with weaker currencies can be bought cheaper, generating greater business and opportunities than if those same goods were more expensive due to a “stronger” currency.

As a result of greater trade, a weak currency can help to offset large trade deficits and can also help make offshore debt more easily repayable.

For instance, the Vietnamese dong, the currency of Vietnam, is one of the weakest currencies in the world, with an exchange rate at the time of writing of roughly US$1 dollar to 23,170 dong.

A currency can be manipulated into being weaker in a number of ways. For instance, a country’s national bank can purchase large amounts of foreign currencies while printing and selling its own national currency.

In doing so, the national currency becomes “weaker,” especially as more is printed, relative to other international currencies.

And it is these methods that have now landed Switzerland and Vietnam in trouble with the US.

In defining a currency manipulator, US authorities look at the amount of “intervention” a country makes in its currency markets, the size of that country’s trade surplus with the US and other factors.

By these metrics, the US has declared Switzerland and Vietnam to be currency manipulators because of how they’ve intervened in their currency markets to keep the value of their respective currencies low, helping exports.

In the case of Switzerland, US authorities allege that, in the 12 months leading up to June 2020, the Swiss trade surplus with the US increased rapidly, largely as a result of gold exports in the first half of 2020 and because of the Swiss franc’s reputation as a “safe haven” currency.

As exports have risen with the US, so has the value of the franc, which Swiss authorities allegedly attempted to keep from appreciating. This was achieved by massive intervention in the currency markets by Switzerland, amounting to some 14% of the country’s total economic output, according to the US.

Unfair advantages

According to Peter Boockvar, chief investment officer for Bleakley Advisory Group, “Switzerland deserves” the label of currency manipulator “as they are printing massive amounts of money and then buying U.S. stocks,” preventing the Swiss currency from appreciating and maintaining an unfair advantage in trade with the US.

For Vietnam, US officials allege that as the country’s trade with the US has risen as a result of companies shifting supply chains there to avoid the US-China trade conflict, Vietnam has intervened to prevent its currency from growing “stronger,” with a weak currency better serving international exports.

The US had a goods and services trade deficit with Vietnam of around US$55.8 billion in 2019.

US officials said that these actions allowed Vietnam to gain an “unfair competitive advantage in international trade,” profiting from greater US investment and business, but not allowing its currency to match this.

Treasury Secretary Steven Mnuchin said that the recent designation was a “strong step” to “safeguard economic growth and opportunity for American workers and businesses” and the Treasury will follow up with work “toward eliminating practices that create unfair advantages for foreign competitors.”

With the designation, both countries will likely enter into negotiations with the IMF to reach a resolution with the US.

But the designation adds yet another foreign policy conundrum for the incoming Biden administration to ponder, alongside the overarching and dominating issue of US-China relations.

Have a tip or story? Get in touch with our reporters at tips@themilsource.com

Comments ()