What’s with the new merger Between AT&T and Discovery?

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

AT&T – which owns HBO Max – has just announced a merger with Discovery in a US$43 billion deal that combines WarnerMedia and Discovery+ to form a new, unnamed company.

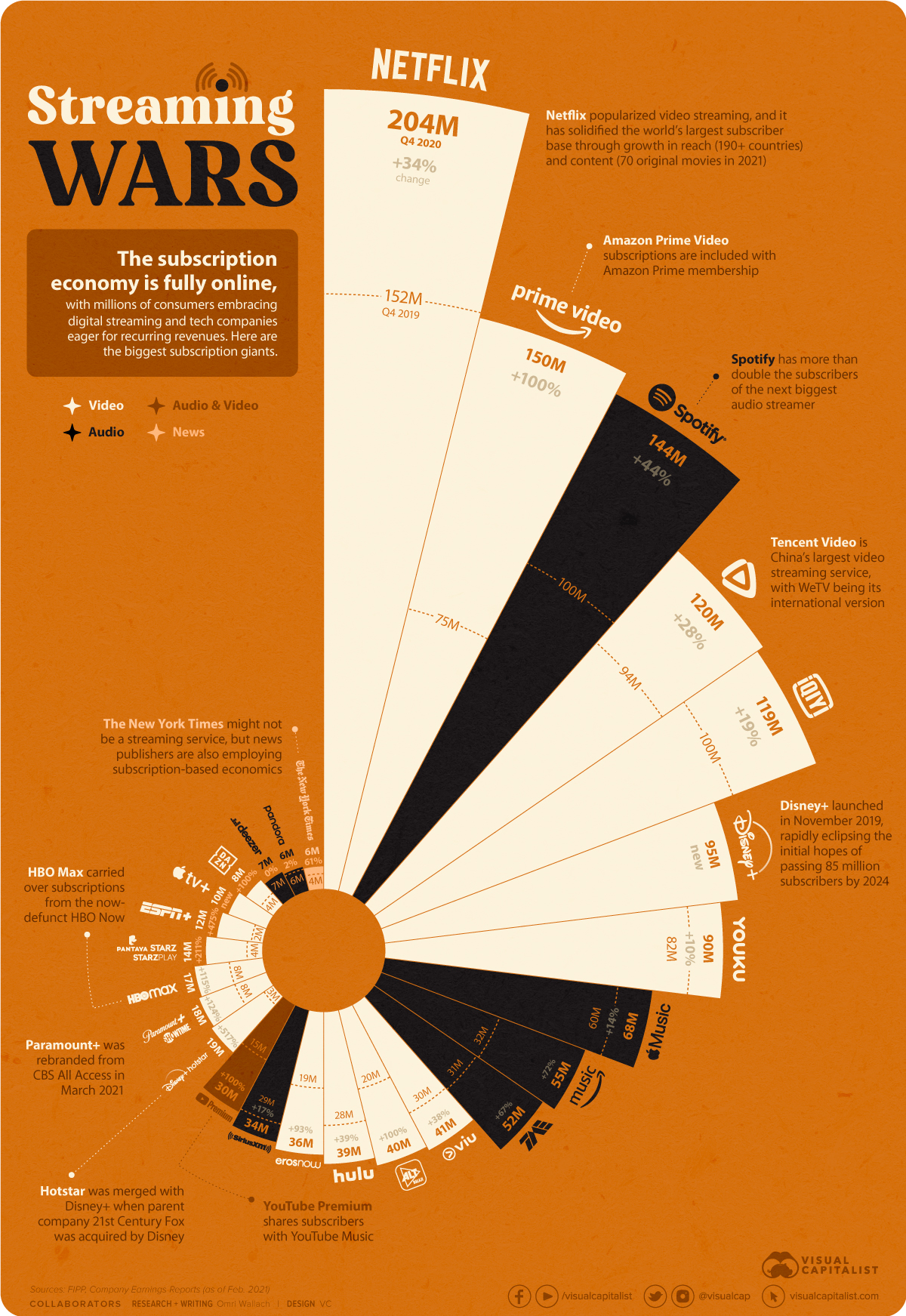

- Whether it is Netflix, Amazon Prime, or Disney+, streaming services are more popular than ever and the industry continues to grow.

- AT&T – which owns HBO Max – has just announced a merger with Discovery in a US$43 billion deal that combines WarnerMedia and Discovery+ to form a new, unnamed company.

- The new company will be in direct competition with Netflix, Amazon, Apple, Disney and Comcast, which are all assembling a growing arsenal of original media content.

Why does AT&T own HBO Max?

- In 2018, AT&T bought out Times Warner Inc. – one of the largest cable providers in the United States – in a US$80 billion deal that resulted in the company changing its name to WarnerMedia.

- Buying Time Warner was a bold way for AT&T to claim some of Hollywood’s most prized assets, including HBO, CNN and the Warner Bros. studio.

- At first, industry experts were a bit skeptical of the buyout since AT&T was investing in a company that primarily focused on cable television rather than on streaming, which was more popular.

- This wasn’t the first time AT&T made a seemingly bad deal by acquiring a popular television service.

What happened between AT&T and DirectTV?

- Initially a phone and internet service, AT&T looked to expand its reach into television by buying DirectTV – a satellite television service – for US$48 billion in 2014.

- Acquiring DirecTV made AT&T the largest pay-TV provider in the US.

- But the deal could not have come at a worse time as many consumers were switching from traditional television services to streaming services, which were more versatile and cheaper.

- In an effort to get back some of the money the company had lost by buying the television service, AT&T offloaded its DirecTV operations in a deal for about US$16 billion in February of this year.

- This recent merger with Discovery along with the dropping of DirectTV shows that AT&T is shifting its focus away from cable television and onto streaming.

Has anything like this happened before?

- This isn’t the first major merger of streaming platforms that have occurred within the industry.

- Companies such as The Walt Disney Company have found more ways to make money through the industry by taking on several platforms under the same company.

- Disney currently owns Disney+, Hulu and ESPN+ and offers bundles for the different platforms. This new company will likely do something similar for Discovery+ and HBO Max according to industry experts.

What does this new company offer?

- The companies said that they should be able to invest more in original streaming content.

- The new company will house almost 200,000 hours of programming and bring together more than 100 brands under one company including: DC Comics, Cartoon Network, Eurosport, Magnolia, TLC and Animal Planet.

Is AT&T or Discovery in charge of the new company?

- Discovery’s chief executive officer David Zaslav will lead the new company, but the leadership effort is clearly shared equally by both companies.

- While Discovery’s CEO will be in charge, AT&T holds majority power on the board in an effort to balance power between the two companies.

- The new company’s board will have 13 members, seven will initially be appointed by AT&T, including the chairperson. Discovery will initially appoint six directors, including Zaslav.

- The deal isn’t finished just yet: it still needs approval from Discovery shareholders and regulators, but with the announcement already public, it’s pretty much a certainty.

- The deal is expected to close by the middle of next year.

Have a tip or story? Get in touch with our reporters at tips@themilsource.com

Comments ()