From Hong Kong trawling for talent to Liz Truss throwing in the towel – Here’s your October 21 news briefing

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

To start off, we’re looking into:

How Hong Kong is attracting top talent

Yesterday, we broke down key points of Hong Kong Chief Executive John Lee’s policy speech. One topic he spoke on that’s super relevant right now revolves around attracting talent back to the city. Many residents have chosen to leave the city for rival financial hubs like Singapore in the past few years, and Hong Kong’s population dropped 1.6% in mid-2022. To stay ahead in finance and tech, Lee just announced new approaches for drawing in talented professionals.

Already, Lee’s government wants to set aside US$3.8 billion to bring in businesses. Another incentive is the new Top Talent Pass Scheme, which would allow foreigners who earn around US$318,000 or more and graduates from the world’s top universities who have at least three years of work experience to get a pass “for exploring opportunities in Hong Kong.” Plus, foreigners who enter Hong Kong on a talent visa become permanent residents and buy a home can get a refund on the stamp duty usually attached to these purchases.

Tesla’s pumping up

Even though it’s worth US$700 billion, Tesla hasn’t quite been living up to expectations lately. The Q3 2022 financial results just came in, and although the company just slightly missed revenue expectations, it delivered on earnings. Since reporting its Q3 earnings, Tesla has seen a share dip of 17%.

On Wednesday, CEO Elon Musk announced that Tesla will probably start a share buyback in 2023. Depending on board approval, this scheme could range between US$5 billion and US$10 billion. Basically, a company will buy back shares from investors at market price if they think it’s undervalued and they’re looking to boost the price of that stock.

And Musk clearly thinks that Tesla’s stock is undervalued, saying that he can see Tesla eventually being worth more than Apple (US$2.3 trillion) and Saudi Aramco (US$2 trillion) combined. He made a point to also mention that he sees this happening without even including Tesla’s AI product Optimus into the mix.

Liz Truss had the worst day

We talked yesterday about how UK Prime Minister Liz Truss was being hammered politically. Her approval rating was in the single digits; she announced a tax plan that made the national bank have to roll out emergency stimulus; and then she had to fire the treasury secretary and roll back the plan. And yesterday, one of her cabinet ministers resigned with a scathing letter, all while Parliament held what some saw as a vote of confidence in her administration – and it didn’t go well … at all.

Well, on Thursday, she announced that she was resigning from the meat grinder that had become Downing Street during her mere six weeks in office.

To be fair, Truss came in during a politically-challenging period when inflation was on the rise. But her policies seemed to exacerbate, not ease, the problem at hand. Her time as the prime minister marks the shortest ever in the country.

This news briefing was brought to by Hong Kong FinTech Week 2022

This year’s Hong Kong FinTech Week features the Global Fast Track program, which “brings together the world’s most innovative and commercially successful fintech companies to showcase their business solutions and connect with regional thought leaders and investors with deep expertise in fintech.”

Finnovasia partners with varying companies and investors to help propel businesses and teams with huge potential growth. For example, last year, over 400 introductions were made.

Get your tickets today for 10% off.

To end, we’ll look into:

How some banks are greenwashing (and what you can do about it)

Banks are learning the value of catering to the eco-friendly crowd by advertising that they’re helping to fight climate change. This makes sense since ESGs are on the rise, which essentially means that investors are looking to make investments in more environmentally and socially responsible companies.

But it turns out that some of these banks may be greenwashing. In the UK, HSBC got slapped with a ban on two of its advertisements claiming the bank was working to plant trees in the UK and help its clients become net zero.

According to the British Advertising Standards Authority, this was misleading since HSBC still funds many companies with extremely high carbon emissions. This is a big deal since it’s the first time in the watchdog’s history that it has acted against greenwashing advertisements – ads that make claims of eco-friendliness that are misleading or even downright false.

And, in Canada, activists are taking charge by calling banks out for not representing their climate goals honestly. Six applicants – including a member of an Indigenous group – wrote complaints to the country’s Competition Bureau, saying the Royal Bank of Canada was misleading about climate action.

The Canadian government is already working on requiring ESG reporting soon, and regulators are looking into those complaints to see if they’re legally viable. The bank, on the other hand, is arguing that the complaints are unfounded.

Experts say the real way banks have a climate impact is in the way they invest. They say the best way to keep banks in check is to keep an eye out for ‘feel good’ claims that don’t have much substance behind them (like a fintech company’s claim to “reforest while you shop”) and look into a bank’s reports, keeping an eye out for heavy investing in fossil fuels or low levels of ESG investing.

In other news …

📉Stocks: MSCI’s global gauge of stocks was down 0.41% to 2429.26

📰Some specifics:

- Dow Jones slipped 0.30% to 30,333.59.

- Nasdaq Composite fell 0.61% to 10,614.84.

- S&P 500 dipped 0.80% to land at 3,665.78.

- Hang Seng Index lost 1.40%, settling at 16,280.22.

🧠Some quick factors to bear in mind:

- US markets had choppy trading, with stocks ending lower, as investors weigh earnings reports and keep an eye on the bond market.

- Treasury yields are only getting higher, causing some hesitation for investors. The rising yield environment contributes to strategists’ skepticism that the market may not keep up its recent rally.

- But, the 3Q earnings season has kept up better than expected. As earnings roll in, traders are concerned the Fed might continue its aggressive interest rate hike policy. With that, markets are now forecasting another 75 basis point rate hike from the Fed next month.

- In China, data suggests it’s losing more manufacturing and export market share to other Asian countries, with the zero-COVID stance affecting its position in global markets. But, there are reports that officials are considering reducing COVID quarantines to seven days from 10 days, which could help boost local industry.

- We are still waiting on key economic data from China, which has been indefinitely delayed due to the CCP Congress.

👄Some comments and chatter:

- “As long as official policy is to make the stock market go down, so that people are less wealthy, so that they buy fewer things, so that prices stop going up, all while doing nothing about fiscal policy, we believe the correct posture is to be bearish on stocks and bullish on inflation,” Greenlight Capital’s David Einhorn said in an investor letter.

- “Drilling down to the individual commodity groups exported from China, we observe that China has been continuing to lose market share, with Vietnam amongst the countries gaining importance on the international landscape,” said Antonella Teodoro, senior consultant at MDS Transmodal.

🛢Oil: Oil prices were pretty stable as a tighter supply was balanced by news that China might relax its COVID restrictions. US crude went up by 0.5%, hitting US$85.98, and Brent went to US$92.38 per barrel, down 0.3%.

👛Bitcoin: Bitcoin dropped 0.32% today, hitting US$19,056.00 at the time of writing.

👩⚖️Illegally sending Russia tech: On Wednesday, the US Justice Department charged several foreign nationals and two different companies with crimes related to sending military tech to Russia, some of which was recovered in Ukraine’s battlefields. Some of the defendants also tried to ship tech related to “nuclear proliferation,” but it was intercepted.

⚕Indonesia bans cough syrup: After the deaths of 99 children linked to certain medicinal syrups, Indonesia has announced a ban on all syrup and liquid medicine (both prescription and OTC). This move comes as health authorities look into the children’s deaths from acute kidney injury.

🔫US-Taiwan weapon coproduction: The US Biden administration could be looking to jointly produce weapons with Taiwan. This could increase production capacity for US-designed arms, speed up their delivery and deter any action from China.

✉India’s Congress party’s non-Gandhi prez: For the first time in 24 years, India’s Congress party just appointed its first president who isn’t a member of the Gandhi dynasty – Mallikarjun Kharge. The party is looking to fight its own decline and start building a real opposition to Indian Prime Minister Narendra Modi. Ever since Modi took office, he’s called the Congress party a “family business,” referring to its Ghandi legacy.

💰India’s Google woes: India’s antitrust regulator fined Google 13.4 billion rupees (US$162 million) for being anti-competitive with its Android smartphone OS. It’s claiming Google forced users to install its own apps on new Androids to strengthen its market position.

💻Chinese chip firms have emergency talks: China’s top tech overseer called several emergency meetings with major semiconductor companies to figure out the damage from Biden’s chip restrictions, also pledging support for the critical sector.

🤝GoTo Group in talks for a stake sale: Indonesia’s largest tech company, GoTo Group, is in talks for a sale of about US$1 billion of its stakes to avoid a stock crash when the lock-up on its holdings ends next month. Right now, GoTo is seeing if early backers like Alibaba and SoftBank would allow for a managed sale of some of their shares to new investors.

😷China’s possible reduced quarantine: Chinese officials are in discussions to reduce how much time travelers to the country must quarantine. They may cut the quarantine period to two days in a hotel and then five days at home. Meanwhile, in Hong Kong, officials may allow attendees of a banking conference to leave the city via private jet if they test positive for COVID.

🦴Family of Neanderthals found: In a Russian cave, fossilized bone fragments of a father, teenage daughter and other related Neanderthals (probably cousins) have been found with stone tools and bison bones. Scientists say this is the first known family of Neanderthals discovered. There were 11 of them in total.

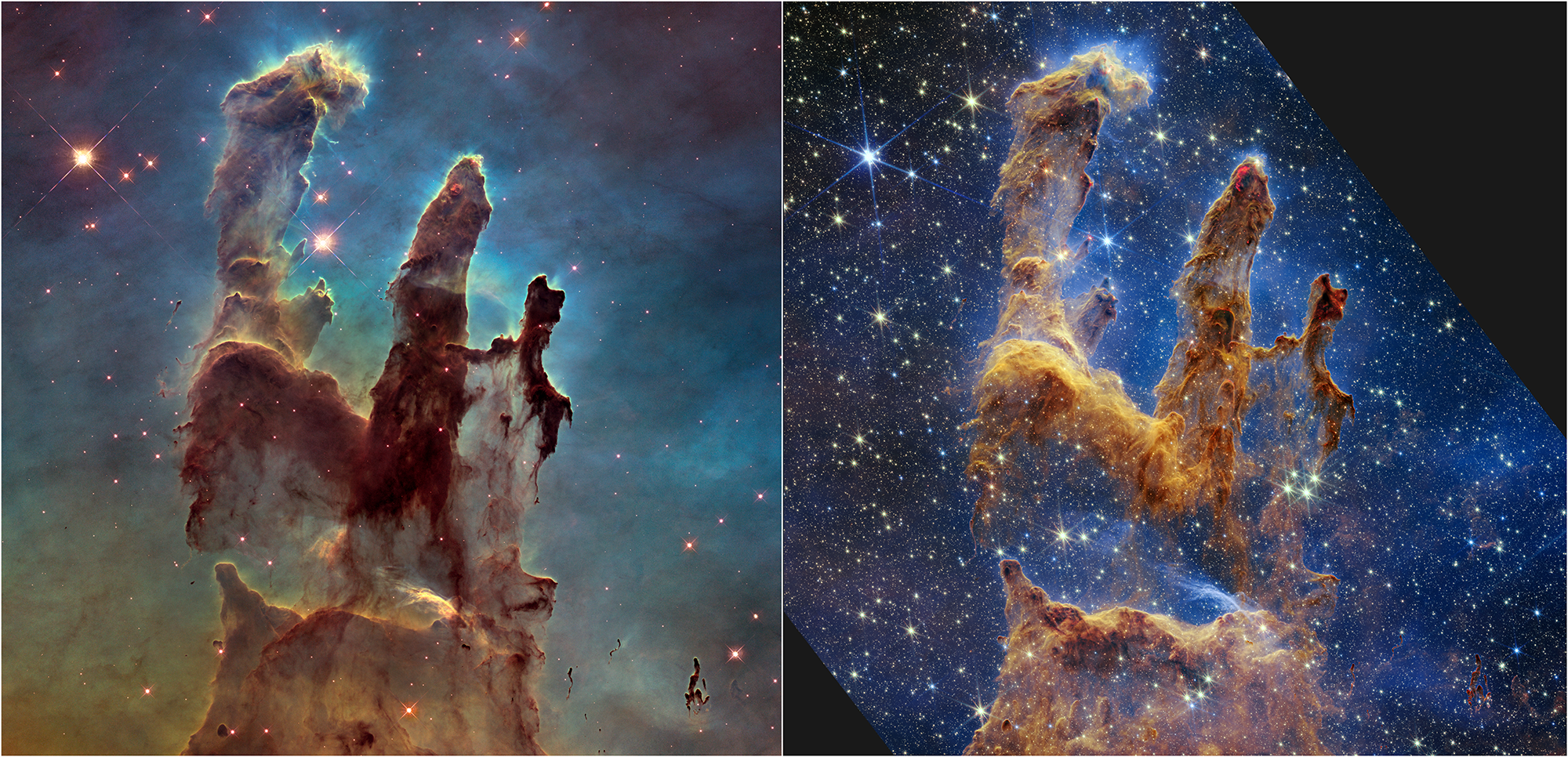

🌌New James Webb photo drop: On Wednesday, NASA released new James Webb Space Telescope photos of iconic outer space Pillars of Creation, which are made of gas and dust against a backdrop of stars. This is the telescope’s first shot of the Pillars, which are 6,500 light years away from Earth.

Written and put together by Jake Shropshire, Vanessa Wolosz, Christine Dulion and Krystal Lai

Comments ()