16.8 million Americans have filed for unemployment

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

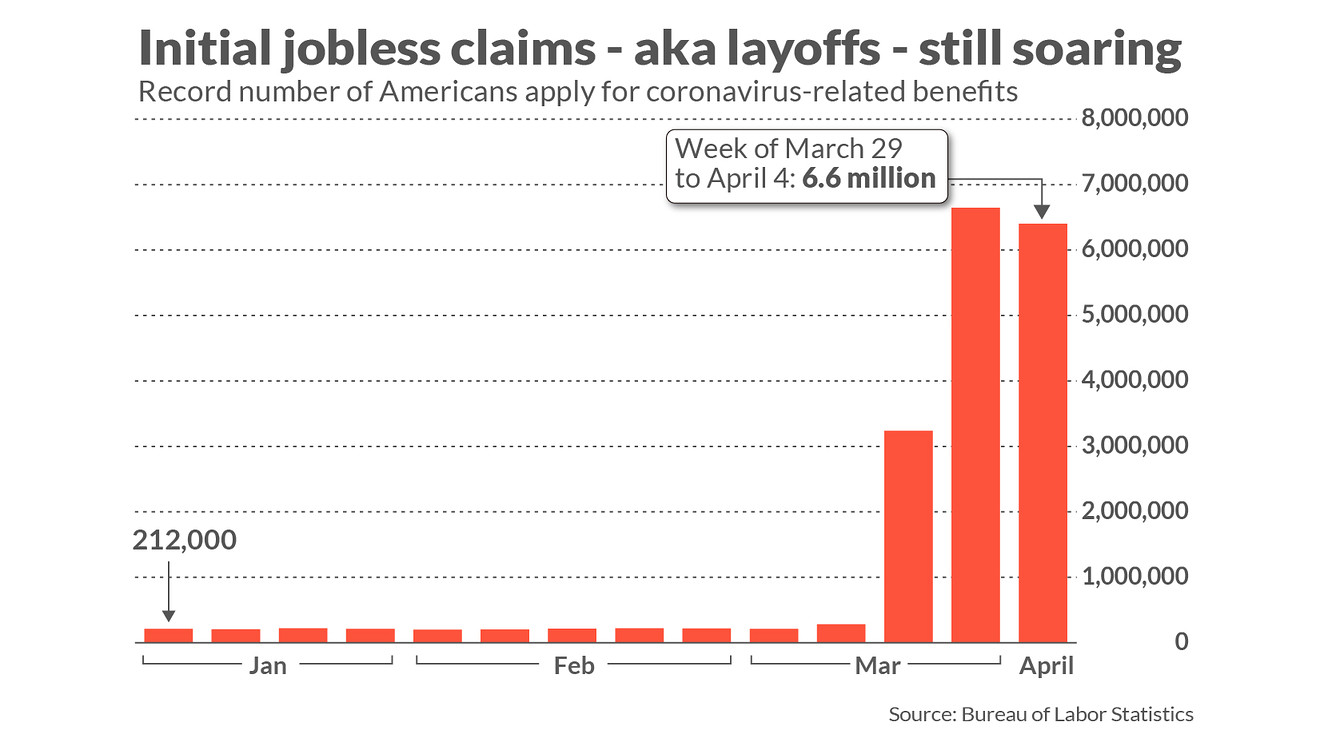

An additional 6.6 million Americans have filed for employment, bringing the total number of unemployment claims to 16.8 million in the span of three weeks. This is far and away the largest number of unemployment claims over such a short period of time since the Labor Department began collecting unemployment data in 1967.

In their Economic Policy Institute (EPI) report, economists Elise Gould and Heidi Shierholz wrote that the figure roughly equates to if the “entire adult population of Michigan, Minnesota, and Wisconsin applied for unemployment insurance in the last three weeks.”

Prior to this week, according to chief economist Joshua Shapiro of MFR Inc., the highest weekly jobless reading was 695,000 in 1982. Furthermore, according to the United States Labor Department, the numbers from the last week of March had to be readjusted for an increase of 219,000 to a total of 6.87 million.

This readjustment comes as experts acknowledge the likelihood that actual unemployment numbers are likely much higher. The discrepancy is largely thought to be due to states struggling to process the influx of new jobless claims.

Consumer sentiment also dropped from 89.1 to just 71 in early April, the largest one month decline on record and the lowest overall level recorded since 2011.

Government responds

The number of unemployment claims were announced as the central bank declared plans for an additional US$2.3 trillion in loans to help bolster the United States economy.

According to a statement from US Federal Reserve Chairman Jerome Powell, these additional efforts were undertaken by the Central Bank to “provide as much relief and stability” as possible to the struggling economy.

The bedrock of the US$2.3 trillion funding plan is a US$600 billion “Main Street Lending Program” that acts to support small and mid-sized enterprises (SMEs) that were in good financial health prior to the pandemic. It offers “4-year loans to companies employing up to 10,000 workers or with revenues of less than $2.5 billion.”

Principal and interest payments on the loans will also be deferred for one year, the aim of which is to keep employees on these companies’ payroll.

An additional $500 billion will be lent to struggling state and local governments. Loan programs will also be expanded to assist large companies.

The other side

At the daily coronavirus task force briefing at the White House on April 9, US President Donald Trump expressed confidence that the economy would “have a big bounce” and “open up strong.”

Trump is not the only one to express this sentiment. Treasury Secretary Steve Mnuchin believes that the jobless numbers “right now aren’t relevant,” saying that he believes that many of those recently laid off from their jobs would be rehired after the government’s US$2.2 trillion economic relief package is implemented.

Others, however, remain skeptical.

“It’s not an on-off switch,” says Jonathan Millar, a deputy chief US economist at Barclays.

Regardless, the market responded positively to the news. Stocks jumped when markets opened on Thursday, with the Dow Jones industrial average gaining nearly 2%, around 450 points, despite the massive new unemployment numbers.

[article_ad]

Have a tip or story? Get in touch with our reporters here!

Sign up for daily news briefs from The Millennial Source here!

Comments ()