Senate approves extension of the Paycheck Protection Program

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

On Tuesday, the United States Senate voted unanimously to extend the Paycheck Protection Program until August 8, providing relief to small businesses during the pandemic.

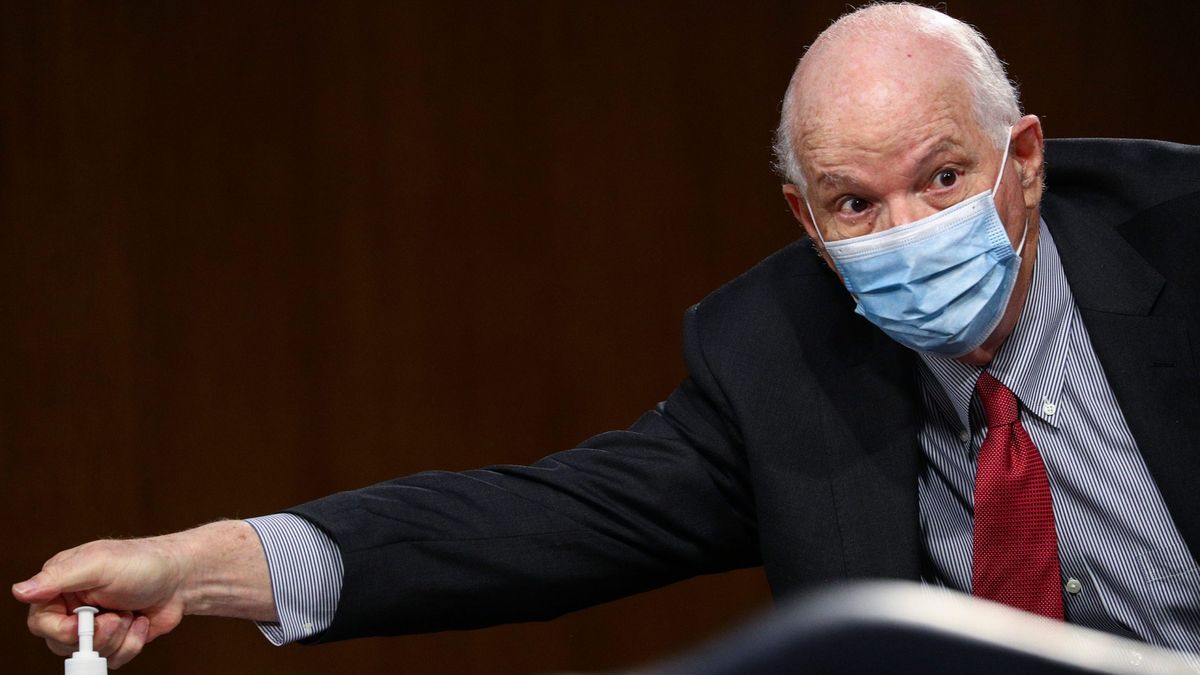

Senator Benjamin Cardin, a Democrat from Maryland and a member of the Small Business Committee, asked for unanimous consent to extend the program from all 100 senators less than four hours before it was set to expire, with more than US$130 billion still unspent.

“The resources are there. The need is there. We just need to change the date,” Senator Cardin stated.

When the House will take up the bill remains unclear, as both chambers of the Congress are set to adjourn for a 14-day recess by the end of the week for the Fourth of July holiday.

The extension means that the program, which has helped more than four million businesses, can now continue to take low-interest loan applications for the next five weeks from small businesses requiring financial aid. The loans can be forgiven if businesses utilize 60% of it to cover employee payroll costs, including benefits.

The Payment Protection Program was launched on April 3 and has, since then, allotted more than US$520 billion in loans.

The first US$349 billion approved by Congress to assist small businesses was borrowed over the first 13 days. Another US$310 billion in loans was approved two months later, of which US$135 billion remained after borrowing slowed. This was attributed to a declining interest in the program due to often changing and confusing rules that borrowers found difficult to comply with, leading to fear that their loans wouldn’t be forgiven.

However, Democratic Senator Chuck Schumer of New York emphasized how there could be renewed appeal for the program as cases of the virus surge again, leading to continued economic troubles for businesses forced to shut down.

“There are large numbers of businesses who are going to need to apply now. Had this program run out today, they would have been out of luck. Now with this renewal, short time, August 8, they at least get the chance to reapply,” Schumer said.

Meanwhile, questions on which businesses will be targeted for the distribution of the leftover funds remain unanswered

Lawmakers who legislated the program have started drafting another piece of legislation to address the matter. However, no agreement is expected to be reached until the end of July.

On Tuesday, at a House Financial Services Committee hearing, Treasury Secretary Steven Mnuchin stated that the Trump administration supports the legislation passed by the Senate to use the remaining funds, adding that he has discussed how the funds will be directed with the Senate Small Business Administration Committee.

“I’ve already had conversations with the [Small Business Administration] committee in the Senate about repurposing that $135 billion and think that should be done, and look forward to working with both the House and the Senate so we can pass legislation by the end of July,” Mnuchin said.

Mnuchin added that their goal would be “extending it to businesses that are most hard-hit, that have requirements that their revenue have dropped significantly — things like restaurants and hotels and others where it is critical to get people back to work.”

Senator Marco Rubio, a Republican from Florida and the chairman of the small business committee, is working on such legislation.

According to a draft copy of the bill obtained by The Washington Post, US$25 billion will be given out to businesses with less than 10 employees. Hotels and restaurant chains will not receive more than US$2 million. Under the bill, programs would also be created to provide financial assistance to businesses in low-income communities.

“Obviously we’ll have to be more targeted at truly small businesses,” Rubio told reporters. “In addition to that, I’m also developing a program to provide financing for businesses in underserved communities or opportunity zones and other zip codes that would fall in that category.”

“We’re talking to the White House about it,” Rubio added. “They’ve expressed to us that they have no intent of repurposing that money for something else, but our hope is that we can use that as the sort of foundation for building a second round of assistance in a more targeted way.”

The bill discussed by Rubio would have to be approved by the Senate and the House before President Trump can sign it into law.

Have a tip or story? Get in touch with our reporters at tips@themilsource.com

Comments ()