The US effort to cut off China’s access to semiconductor technology, explained

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

The latest round of sanctions appears targeted to undermine China’s efforts to become self-reliant in semiconductor technology and maintain America’s leadership of the industry.

The United States Department of Commerce recently announced new sanctions against China’s homegrown semiconductor chipmaker, Semiconductor Manufacturing International Corporation, or SMIC.

The sanctions come as yet another escalation in the deepening trade war between the two countries, which has already seen other Chinese tech companies, such as ByteDance Ltd. and Huawei Technologies Co., Ltd., face their own sanctions and potential questions over their future operations in the US.

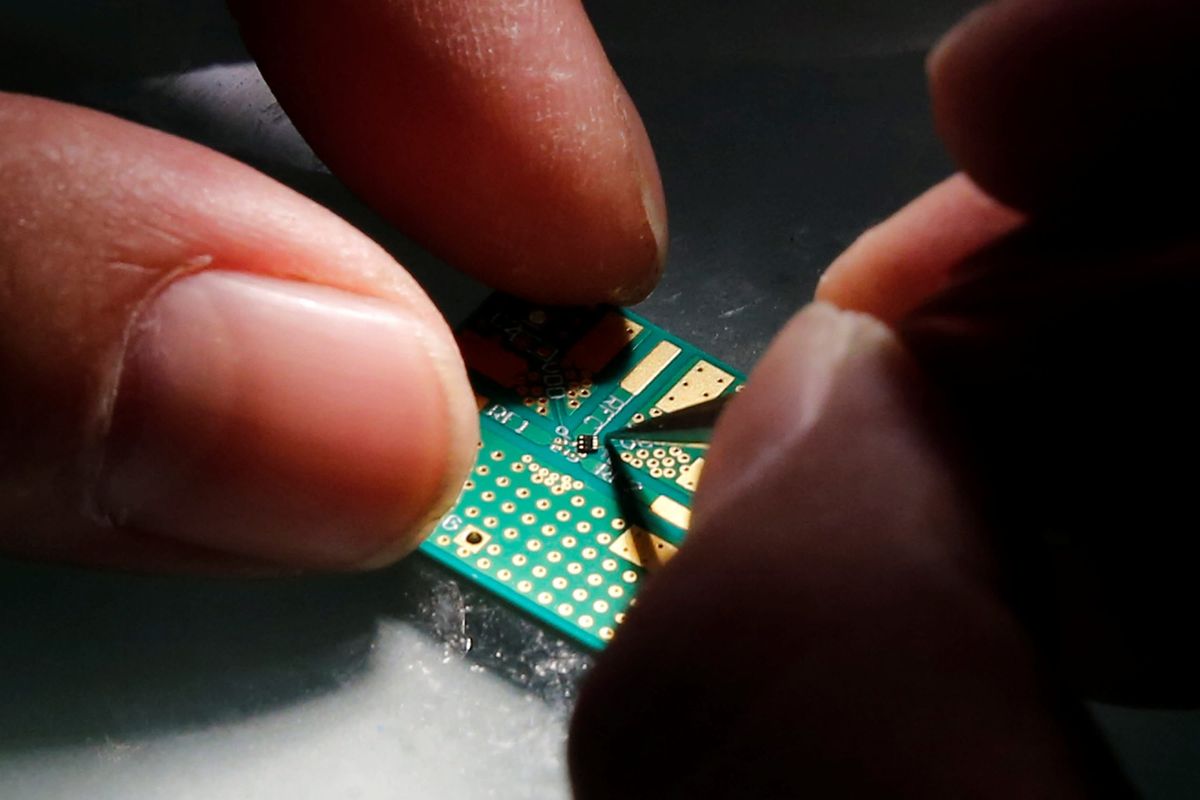

The latest round of sanctions appears targeted to undermine China’s efforts to become self-reliant in semiconductor technology and maintain America’s leadership of the industry. Semiconductors are crucial components in millions of modern appliances, powering everything from smartphones to larger devices.

But US companies themselves may face a backlash from these new sanctions. US semiconductor companies conduct billions of dollars worth of trade with Chinese companies that the new sanctions have made more uncertain than ever.

Semiconductor war

The latest round of sanctions against SMIC appears to have been a longtime coming.

In late August, senior Chinese government officials and business leaders who had gathered at the 2020 World Semiconductor Conference appeared all but certain that new US sanctions would target this crucial industry in particular.

The implications of any attack from the US on China’s semiconductor industry were too big to ignore. The US is the biggest global producer of semiconductors, accounting for some 47% of the global semiconductor market, with South Korea second with 19%. China presently accounts for just 5% of the global share of this multibillion dollar industry.

Any attack, then, would be disastrous for Chinese companies still attempting to reach the level of the US. Wang Xuguang, chief executive officer of Chinese chipmaker AINSTEC commented that China is “at least 20 years behind comparing to Silicon Valley from scale and quality of talent to size of the ecosystem,” with China’s chip industry “too fragile to defend itself.”

As Stanley Chao, author of “Selling to China,” told TMS, “the US knows China relies heavily on US-made chips,” and “other industries – oil & gas, auto, agriculture – just aren’t going to make a real impact on China as it has alternative sources.” Cutting the flow of US-produced chips, then, is “a big blow to China.”

For its part, China’s SMIC rejected assertions by US government officials that it had connections to China’s military, concerns which prompted discussions of sanctions to begin with. In September, SMIC stated that “the company manufactures semiconductors and provides services solely for civilian and commercial end-users and end-uses.”

Trump administration officials were evidently unconvinced. In late September, The US Commerce Department’s Bureau of Industry and Security announced sanctions on SMIC, which it stated presents “an unacceptable risk of diversion to a military end use,” despite SMIC’s protests to the contrary.

The new sanctions fall short of placing SMIC on the Commerce Department’s Entity List, which would prevent US companies from dealing with the Chinese company without a license, as has happened to Huawei. Still, licenses must now be acquired for a set of US-origin items and technologies.

SMIC’s shares hit a four-month low after the new restrictions were announced, contributing to a 25% decline in shares for the month in total. More hurt may be on the way. According to analysts, around 50% of SMIC’s equipment originates in the US and its customers and trading partners include US chipmakers Qualcomm Inc. and Broadcom Inc.

For its part, China’s government has accused the US of “blatant bullying” and continuing its pattern of escalating sanctions against some of China’s largest technology companies. Foreign Ministry spokesman Zhao Lijian said the sanctions “violated international trade rules, undermined global industrial supply and value chains and will inevitably hurt U.S. national interests and its own image.”

Self-reliance

SMIC’s sanctions represent but the latest in a series of ongoing US sanctions of Chinese tech companies. Huawei had previously been placed on the US Entity List until at least 2021 and was reportedly suffering a shortage of crucial components before Huawei officials claimed they had “sufficient inventory” to continue operations.

The new sanctions also come as China’s highest officials have sought to make the country more self-reliant in semiconductor technology and technology more generally. China’s President Xi Jinping has referred to China’s reliance on foreign tech as “Qia Bozi,” which according to SCMP is a term roughly translated as “being strangled by an adversary.”

Over the last two years, China has reportedly imported some US$300 billion worth of chips, with US chipmakers such as Qualcomm routinely involved in this trade.

China’s government has sought to reverse this trend. In September, new plans were released for government investment in a range of industries, semiconductors included, and in July, 10-year corporate tax breaks for chip-producing companies were announced alongside extended tax incentives for the entire supply chain.

China still remains a smaller player in the semiconductor industry, despite these ongoing efforts. The US remains the dominant semiconductor producer globally and of the top ten semiconductor companies in the world, none are Chinese.

New American sanctions, then, are largely targeted toward keeping the US the dominant power in this industry. According to Andrea M. Garcia, CEO of COMMS/NATION, a PR agency that works with tech, “semiconductors are essential to the future of all technology.”

Speaking to TMS, Garcia argued that “if China or another country becomes the leader, it puts American technology strategies, innovation, security, and business at risk for only being powerful in the sense of IP.”

But these sanctions may have a knock-on effect for US companies and, consequently, American and Western consumers.

Uncertainty in trade with China has already hurt some US chipmakers. Micron Technology Inc. has seen its shares drop nearly 6% for the year, largely as a result of ending its shipments to China’s tech giant Huawei this September. Micron, alongside San Diego-based chipmaker Qualcomm, have already applied for licenses to continue trade with sanctioned-Huawei, but it is uncertain whether these will be granted.

As Nir Kshetri, Professor at the University of North Carolina-Greensboro and an expert on the Chinese high tech industry, commented to TMS, the recent sanctions against SMIC and others are “likely to have a negative impact on the costs and availability of consumer electronics such as smartphones and computers.”

After all, as Professor Kshetri recognizes, “Qualcomm is a major SMIC client” and its major customers “include Apple and Samsung Electronics,” two of the largest smartphone brands in the US.

As Chao claims, the escalation of US sanctions against Chinese companies demonstrates “what to expect in the future as both countries head toward a bifurcated economy.”

In his comments to TMS, Chao predicts “we’ll have two spheres of influence and each country dictates its own terms related to trade, high-tech, and industrial norms.”

Have a tip or story? Get in touch with our reporters at tips@themilsource.com

Comments ()