The Dasgupta Review urges us to rethink the economics of climate change and nature

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

The Dasgupta Review posits that addressing climate change will require a fundamental reconsideration of the natural world, or, in the economic terms of the report, “natural capital.”

On February 2, Indian-British economist and professor Sir Partha Dasgupta published “The Economics of Biodiversity: The Dasgupta Review.” More than a standard examination of the impact climate change has on the economy, the 600-page Dasgupta Review “sets out how we should account for Nature in economics and decision-making.”

The review was commissioned in 2019 by the United Kingdom’s HM Treasury, the governmental department responsible for the nation’s financial and economic policy. Though the reality of climate change is often debated along partisan lines in the United States, in the UK (and the European Union) there is broad consensus that it is a serious issue that must be confronted.

The Dasgupta Review advises nations and corporations to consider the natural world in terms of its economic value and to account for the effects of climate change like they would the deprecation of any other asset.

Along with the full report, the HM Treasury has published a 100-page Abridged Version and the “Headline Messages,” a 10-page document that summarizes the report in bullet points. The full report is broken into three parts: “Foundations,” “Extensions” and “The Road Ahead.” Importantly, the report not only outlines the economic realities of climate change but also offers solutions.

TMS is offering a summary of the Dasgupta Review in two parts. This, the first part, will look at the overall thesis of the report and its use of economic language to discuss climate change.

Though this summary seeks to accurately report the findings of the Dasgupta Review, not everything discussed in the full report is covered. For instance, much of the report’s discussion of the motivations of “citizen investors” is not addressed. The complete Dasgupta Review can be read here.

What is the Dasgupta Review?

The Dasgupta Review posits that addressing climate change will require a fundamental reconsideration of the natural world, or, in the economic terms of the report, “natural capital.” Befitting Dasgupta’s background as an economist, the language of the review is steeped in economic jargon, including “portfolio of financial assets,” “risk assessments” and “depreciation.”

As Dasgupta explains, economists use these terms to discuss “produced capital (roads, buildings and factories) and human capital (health, knowledge and skills).” The review uses these same terms to discuss the natural capital of the planet. Whereas nature is often thought of as something separate and intangible from base economics, the review argues it is intrinsically tied to all human economy.

In the forward to “The Economics of Biodiversity,” renowned British natural historian David Attenborough lays out one of the main theses of the review:

“Economists understand the wisdom of spreading their investments across a wide range of activities. It enables them to withstand disasters that may strike any one particular asset. The same is true in the natural world. If conditions change, either climatically or as a consequence of a new development in the never-ending competition between species, the ecosystem as a whole is able to maintain its vigour.”

An overview of the Dasgupta Review

In Dasgupta’s preface, he acknowledges, “The Review is both long and technical; in boxes, annexes, and starred chapters, it is even mathematical.” He warns it is not an easy read “because the economics of biodiversity is a very hard subject.”

Yet, he imagines the audience for the report as a regular person who wants “an explanation for how and why we have come to this pass” and an understanding of “how to translate that explanation into recommendations.” He describes this person as a “social evaluator” or “citizen investor,” someone who wants to be a knowledgeable participant in tackling climate change and its effects on the world.

To that end, the “Headline Messages” summary breaks the report into clear, unambiguous thesis statements, which, taken together, form a succinct summary of the Dasgupta Review:

“Our economies, livelihoods and well-being all depend on our most precious asset: Nature. We have collectively failed to engage with Nature sustainably, to the extent that our demands far exceed its capacity to supply us with the goods and services we all rely on. Our unsustainable engagement with Nature is endangering the prosperity of current and future generations.

“At the heart of the problem lies deep-rooted, widespread institutional failure. The solution starts with understanding and accepting a simple truth: our economies are embedded within Nature, not external to it. We need to change how we think, act and measure success. Transformative change is possible – we and our descendants deserve nothing less.”

The economics of climate change

Discussing the natural world in economic terms isn’t a new concept. In 1997, a group of ecological economists published a report entitled, “The value of the world’s ecosystem services and natural capital.” It determined the value of the entire biosphere “to be in the range of US$16-54 trillion per year, with an average of US$33 trillion per year.”

Dasgupta argues this estimate greatly undervalues nature and misunderstands its worth, relying as it does on faulty economic ideas.

“Unfortunately, the macroeconomic theories of growth and development that have shaped our beliefs about economic possibilities and the progress and regress of nations do not recognise humanity’s dependence on Nature. The Review corrects that mistake.”

The Dasgupta Review describes the value of nature in terms of a financial portfolio: “Just as diversity within a portfolio of financial assets reduces risk and uncertainty, so diversity within a portfolio of natural assets increases Nature’s resilience to shocks, reducing the risks to Nature’s services. Reduce biodiversity, and Nature and humanity suffer.”

Ecological research has found that the planet better sustains life when it is allowed to naturally diversify. Unfortunately, humans, in their effort to control the natural world and conform it to their needs, have by and large eradicated natural biodiversity for homogeneous crops. The result is a natural world less able to sustain healthy growth amid “market shifts” or climate change.

Climate change, in economic terms, is a mechanism of “depreciation,” or the reduction in the value of an asset – the asset being the natural world itself. That is to say, the natural world’s value to humanity does not remain constant and our actions as a species play a big part in devaluing it.

“In the case of ecosystems,” Dasgupta explains, “depreciation is the difference between the rate at which it is harvested and its regenerative rate. If human extraction of an ecosystem’s provisioning services exceeds its regenerative rate, the ecosystem depreciates.”

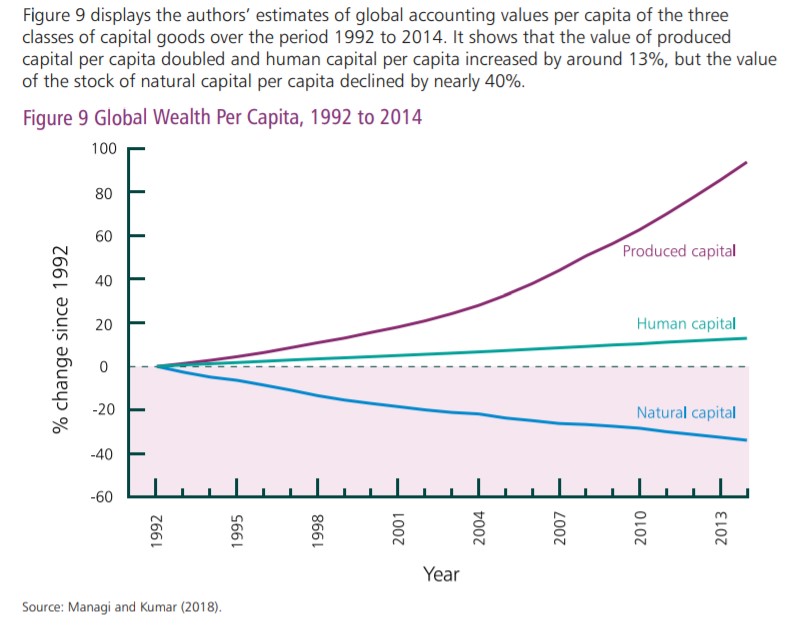

Furthermore, the natural world cannot be separated from all other economic activities. Without a planet capable of sustaining human life, nothing else has value. So, while it is true that the world has grown much wealthier in produced capital (e.g., buildings, roads), natural capital (upon which all other forms of capital relies) lost 40% of its value between 1992 and 2014 alone.

Worse still, the “economic growth” that the world has enjoyed in recent years, including the elevation of millions of people out of poverty, has been achieved through “eroding natural assets.”

That is the crux of the Dasgupta Review and the reason the author argues governments, corporations and people must rethink the natural world. Instead of debating the costs of climate change policies, Dasgupta contends that the value lost if nature is not conserved and restored will be felt across all classes of capital goods: natural, of course, but also human and produced.

“Humanity faces an urgent choice,” Dasgupta warns. “Continuing down our current path – where our demands on Nature far exceed its capacity to supply – presents extreme risks and uncertainty for our economies. Sustainable economic growth and development requires us to take a different path, where our engagements with Nature are not only sustainable, but also enhance our collective wealth and well-being and that of our descendants.”

In the second part of the TMS summary of the Dasgupta Review, we will explore what avenues Dasgupta believes are available for attaining that sustainable economic growth and development while combating climate change.

Have a tip or story? Get in touch with our reporters at tips@themilsource.com

Comments ()