Only six months into 2021, there are 166 new US$1 billion dollar companies in the US. There were only 163 in all of 2020

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

“Decacorn” is the name given to companies valued at US$10 billion. As of February, there are 30 of those, including ByteDance (TikTok’s owner) and SpaceX.

What’s a unicorn again?

- A unicorn is a privately owned company valued at over US$1 billion.

- Aileen Lee, founder of Cowboy Ventures in the United States, created this term to describe how rare it was for a company to reach this level of success – so rare, it has less than a 1% chance of happening.

- According to Lee, Unicorns are “on a mission to build things that the world has never seen before.”

- “Decacorn” is the name given to companies valued at US$10 billion. As of February, there are 30 of those, including ByteDance (TikTok’s owner) and SpaceX.

How does the number of unicorns compare to 2020?

- 2021 started strong with five new unicorns in the first week of the year. Now, less than halfway into 2021, there are 166 new unicorns. To compare, there were 163 for all of 2020.

- This is the second highest number since 2011 (again, we’re not even halfway through the year). In 2018, 178 unicorns were established.

- According to CrunchBase, the number of unicorns has increased from 700 in February to more than 800 in April. This doesn’t even include the 18 companies that either went public or were acquired.

- While most of the companies on the list are American, Chinese financial services company Ant Group is the highest valued unicorn company as of April.

Where are these companies coming from?

- Unicorns have been on the rise since the term was first established back in 2013, when only 39 unicorns existed.

- By 2016, the number of unicorns had grown to 229 in total, with nearly 80% existing in the US and 15% existing in China.

- The industries in which unicorns currently exist include everything from finance and medical care to video streaming services.

- The United States contributed the most to the increase in unicorns, but India came in second with six new unicorn companies.

Who are the investors?

- You’ve probably heard a lot about how aggressive Tiger Global Management has been with its investments this year. They’ve even been compared to Softbank, the Japanese investment fund owned by Masoyoshi Son.

- This is a crossover fund, which means that it invests in both public and private companies. Public companies have stock options while private companies do not.

- In the first quarter of this year, Tiger Global was making around four deals a week according to The Information, throwing money at founders before other investors even had a chance to get in.

- Other active investors during this time include Insight Partners and Accel.

- Sequoia Capital, which is usually one of the biggest investors for unicorns, has been relatively quiet during this period.

Will this trend continue?

- Scott Galloway, professor of marketing at New York University’s Stern School of Business, expressed his concern over how investments in these companies are made in an interview with Forbes.

- Calling major investors a “pump-and-dump mafia,” Galloway stated that “You could argue that on a risk-adjusted basis, somewhere around 50% of companies are overvalued, but people don’t want to have that conversation.”

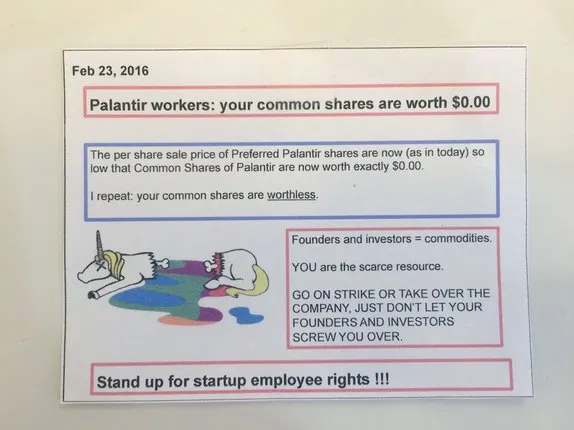

- Concerns like Galloway’s aren’t new. In 2016, the following flyers were posted around San Francisco, warning employees of the American software company Palantir to “go on strike.”

- Tiger Global’s leader and founder Chase Coleman, who rarely speaks publicly, wrote a letter to clients in March of this year, stating that Tiger Global was seeking “to identify high-quality businesses levered to the most important secular growth trends while shorting poorly positioned companies on the wrong side of change.”

- In other words, Tiger hopes to invest in startups that are actively working to change how the industry performs services in order to give it a fighting chance against big companies that are not changing anytime soon.

Have a tip or story? Get in touch with our reporters at tips@themilsource.com

Comments ()