A SPAC lawsuit has paved the way for SPARCs, but what’s a SPARC?

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

Ackman’s reason for pivoting to his SPARC comes in the form of a tweet where he paraphrases a Warren Buffett quote from 1985: “If you find yourself in a leaky boat, oftentimes you are better off switching boats than patching leaks to complete the mission.”

Who’s Bill Ackman?

- Bill Ackman is the founder and chief executive officer of Pershing Square Capital Management, a hedge fund management company.

- The controversial American investor and hedge fund manager has had an interesting history of investments over the past decade.

- But, perhaps his biggest claim to fame was his bet against multilevel marketing company Herbalife Nutrition, which was eventually made into a documentary called “Betting on Zero.”

- He tried to short the company for nearly a billion dollars, but he eventually had to pull out of his short after the company continued to succeed, which is despite Ackman’s public attacks against Herbalife Nutrition.

- His most recent controversy, though, involves his Special Purpose Acquisition Company (SPAC), the biggest SPAC ever at US$4 billion, after it was recently sued by angry investors.

What happened with his SPAC?

- A quick recap: A SPAC is essentially a company that doesn’t sell anything. Its sole purpose is to just raise money from investors, and together, they go look for a private company to merge with and help take that private company public.

- The reason some private companies choose to go public via SPAC is because the process is generally quicker and more company-friendly, compared to the traditional initial public offering (IPO) process.

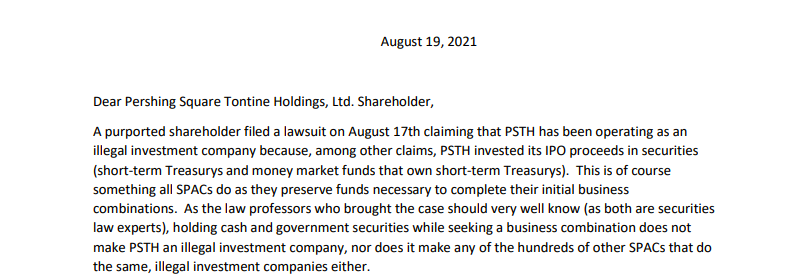

- So Ackman’s SPAC, Pershing Square Tontine Holdings (PSTH), has recently come under fire, after lawyers Robert Jackson, former Securities and Exchange Commission (SEC) commissioner and John Morley, a law professor at Yale, claim that PSTH isn’t really a SPAC.

- So, just simply buying some stock isn’t what a SPAC is meant to do, the lawsuit says. But because the merger with his original private company target, Universal Music Group, fell through, Ackman ended up negotiating a stock deal.

- With that, they say that Ackman’s SPAC is an investment firm, just like his hedge fund.

- “An investment company is an entity whose primary business is investing in securities. And investing in securities is basically the only thing that PSTH has ever done,” states the lawsuit.

Were there any other issues?

- These investors also have a big issue with Ackman’s company promising to repurchase warrants, calling it illegal.

- So a warrant is essentially just a little treat for investors, which promises them the right to buy a share of stock at a certain price by a certain date.

- “The Company agreed to repurchase some of those warrants at a valuation that implied the warrants were worth, in the aggregate, more than $880 million — thirteen times what the Sponsor and Director Defendants originally paid for them,” the lawsuit said. “This staggering compensation was promised at a time when the returns to the Company’s public investors have starkly underperformed the rest of the stock market.”

- So basically, the deal pretty much guaranteed that the leaders of the SPAC would receive huge profits, and angry investors are suing.

- Ackman says that the lawsuit is meritless, and instead, has offered investors the opportunity to invest in his SPARC.

What’s a SPARC?

- A SPARC is something that Ackman made up so it’s probably best to start by just looking at their definition:

- “SPARC is not a SPAC. It is a Special Purpose Acquisition Rights Company. Unlike a traditional SPAC, SPARC does not intend to raise capital through an underwritten offering in which investors commit capital without knowing the company with which SPARC will combine.”

- So, basically, a SPARC is just like a SPAC except, instead of tying money up in a SPAC for two years while the SPAC hunts for a private company, SPARC investors don’t actually have to put up any money until the SPARC finds a deal.

- “The principal benefit of SPARC is that it would not hold investors’ money while we are looking for a target,” says Ackman in his shareholder’s letter. “This eliminates the substantial opportunity cost of capital that burdens all SPAC investors.”

- Rather than a blank check company, it’s more like handing a piece of paper to Ackman’s SPARC that says, “Check coming soon, if you can find us a deal.”

- But there’s one big problem with Ackman’s SPARC: it hasn’t actually been approved by the SEC yet, and he isn’t exactly on good terms with them right now.

What comes next for investors and Ackman?

- Investors who bought in on the SPAC at February’s peak value, have lost about 40% of their investment since.

- Ackman’s reason for pivoting to his SPARC comes in the form of a tweet where he paraphrases a Warren Buffett quote from 1985: “If you find yourself in a leaky boat, often times you are better off switching boats than patching leaks to complete the mission.”

- The question that comes next is whether or not the SEC will actually approve Ackman’s SPARC proposal, but the entire process could take months.

- And, because SPACs operate on a two-year deadline to find a private company to merge with, regardless of whether or not Ackman actually gives investors back their money, the company will be forced to return investor funding by December of 2022 if they can’t find a company to acquire.

- But on Tuesday, Ackman said that he remains committed to finding a merger target for PSTH.

- “Our plan to return cash to shareholders once SPARC is approved does NOT in any way mean that we are walking away from PSTH and giving up on completing a deal," Ackman wrote in the Pershing Square Holdings interim financial statements.

Have a tip or story? Get in touch with our reporters at tips@themilsource.com

Comments ()