With the Pandora Papers published, what’s next?

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

For example, the Kremlin said on Monday that it saw no wrongdoing among Russian President Vladimir Putin and his inner circle. “Honestly speaking, we didn’t see any hidden wealth of Putin’s inner circle in there," said Kremlin spokesperson Dmitry Peskov.

What are The Pandora papers?

- The Pandora Papers are 2.9 terabytes of data that includes 11.9 million leaked documents of financial information from some of the richest people in the world.

- To put this in perspective, pretend that a single byte of data equals one grain of rice. That would mean a kilobyte is about a cup of rice, a megabyte is about eight bags of rice, while a terabyte is an entire cargo ship worth of rice.

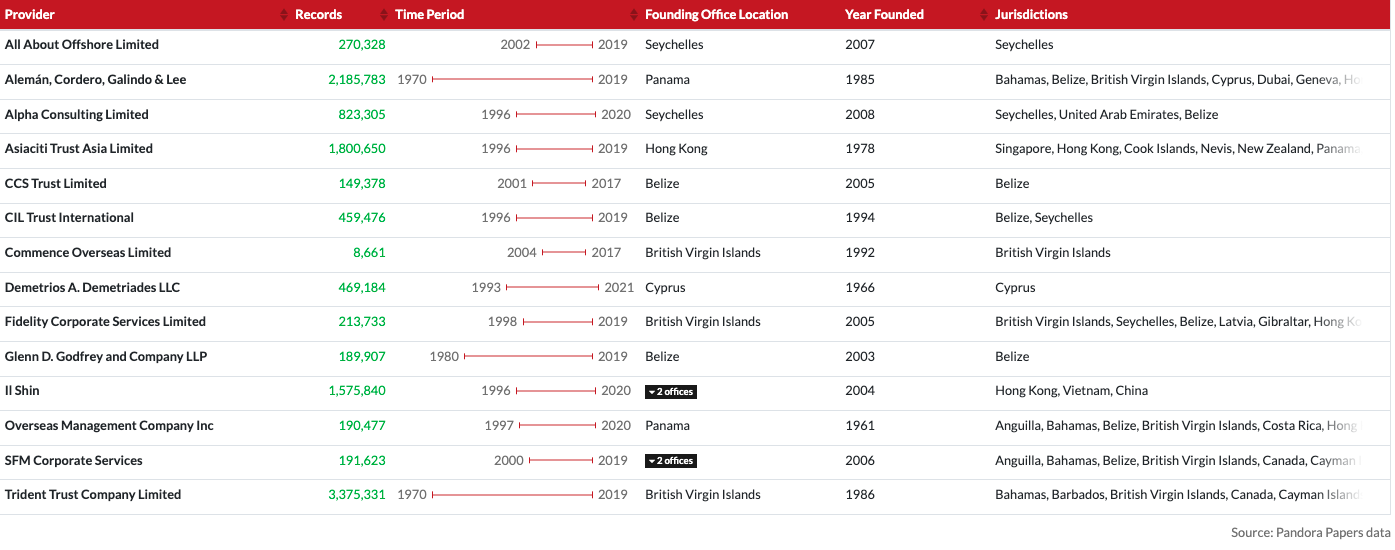

- These papers were released yesterday by the International Consortium of Investigative Journalists (ICIJ) and contain documents, images, emails and spreadsheets from 14 financial service companies, with the most data coming from Trident Trust Company Limited.

- Current estimates believe that there could be between US$5.6 trillion to US$32 trillion of liquid cash, or actual money rather than property or jewellery, that is currently hidden and untaxed.

- The Pandora Papers are much like the Panama Papers leaked a few years ago, except the Panama Papers only leaked 1.5 million confidential documents.

Who’s involved with the papers?

- Up to now, 35 current and former national leaders have appeared in the leak, alongside 400 officials from nearly 100 countries.

- Former British Prime Minister Tony Blair, Kenyan President Uhuru Kenyatta, Montenegrin President Milo Đukanović and Ukrainian President Volodymyr Zelensky, have all been identified in the Pandora Papers.

- Not only are there a bunch of political officials involved, but there are also more than 100 billionaires and 29,000 offshore accounts also listed within the papers.

- Even international celebrities such as Shakira, who was discovered for having set up an offshore company while going on trial for tax evasion, are named in the documents.

- Setting up an offshore company, which most of these people have been caught doing in these papers, makes it extremely difficult to figure out how much money they are making. Setting up an offshore company isn’t illegal, but using it to hide true wealth avoid taxes, on the other hand, is.

Why do these papers matter?

- It’s not just who is in the papers that matter, but why they are in there.

- For instance, Kenyan president Uhuru Kenyatta’s family secretly owned a network of 13 offshore companies for decades worth over US$30 million.

- “The ability to hide money has a direct impact on your life,” said Lakshmi Kumar from American think-tank Global Financial Integrity. “It affects your child’s access to education, access to health, access to a home."

- On the other side of the investigation is the ICIJ, who worked with over 600 journalists from 150 media outlets, including news organizations such as The Washington Post, the Australian Broadcasting Corporation and The Guardian.

What are some government leaders saying about the papers?

- Most of the world is kind of in an uproar over these papers as leaders worldwide speak out regarding their involvement in these schemes. But responses also vary depending on the individual.

- For example, the Kremlin said on Monday that it saw no wrongdoing among Russian President Vladimir Putin and his inner circle. “Honestly speaking, we didn’t see any hidden wealth of Putin’s inner circle in there," said Kremlin spokesperson Dmitry Peskov.

- Pakistan’s prime minister, Imran Khan, said his government would investigate key members of his inner circle listed in the document. He also took to Twitter to voice his outrage over the actions committed by the rich elite.

- “If any wrongdoing is established, we will take appropriate action. I call on the international community to treat this grave injustice as similar to the climate change crisis,” Khan tweeted while comparing the rich elite to the East India Trading Company that robbed India of its wealth.

- On the other side of the reactionary scale, billionaire Czech prime minister Andrej Babiš reacted angrily to the release of the papers saying that this was a plot to undermine the upcoming election after it was reported that he hid his ownership of a US$22 million French chateau.

- “So it’s here. I had expected them to pull something out on me just before the elections in order to harm me and influence the Czech elections,” Babiš tweeted while stating that he had never done anything “illegal or wrong”. “That does not prevent them from trying to denigrate me again and influence the Czech parliamentary elections.”

What’s next?

- It isn’t an exaggeration to say that the Pandora Papers is the biggest financial data leak in the history of the world.

- The United States has already announced extra measures recently to crack down on tax evasion including expanding funding for Internal Revenue Service (IRS), and President Biden has already stated that his cabinet would be taking measures to ensure that the rich would not get away with avoiding taxes.

- Australia had a similar response. “We have some of the best auditors, investigators, analysts and data scientists in the world who work together to sort the good from the bad, ensuring no stone is left unturned,” said Australian Tax Office (ATO) Deputy Commissioner Will Day

- As far as what comes next, only speculations can be made based on what happened when the Panama Papers were released back in 2016. But, Mossack Fonseca, the man who set up more than 214,000 shell companies and the centre of attention in the Panama Papers, has yet to face criminal prosecution for his participation in his money laundering activities.

- Alex Cobham, an economist and chief executive of the Tax Justice Network, called the “personal actions” of some in the leak shameful but said that the real criminals are the bankers and law firms that enabled them to do this.

- “Few of the individuals had any role in turning the global tax system into an ATM for the super-rich,” says Cobham. “That honour goes to the professional enablers – banks, law firms and accountants – and the countries that facilitate them.”

You drive the stories at TMS. DM us which headline you want us to explain, or email us.

Comments ()