How governments around the world are scrambling to lower oil prices

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

President Joe Biden is trying pretty hard to get those prices down. One of the ways he’s doing this is by tapping into the Strategic Petroleum Reserve (SPR) and releasing 50 million barrels of crude oil into the market.

What’s OPEC?

- Before we start, just because this is just a “good to know and get out of the way" fact, the Organization of the Petroleum Exporting Countries, aka OPEC, is a group of 13 countries that account for over 80% of the world’s extractable oil reserves.

- The group was formed to pretty much make sure that oil prices remained stable within global oil markets.

- Now, because these countries control the majority of the world’s oil reserves, they also essentially control the supply, and therefore, the pricing.

- The world is currently experiencing a tight supply of oil, which has massively pushed up the oil prices and contributed to the high inflation we’re seeing globally.

- But, OPEC is refusing to tame soaring energy costs by increasing supplies, which have made countries scramble and tap into their reserves (like the oil you keep on the side in case you need it, sort of an oil fund for a rainy period).

How are countries scrambling?

- Well, Inflation is at a super high right now.

- Compared to the goal rate of around two percent, it reached 6.2% in last month in the United States. And, it’s also a problem affecting other countries as well.

- And while American consumers are definitely feeling it, one of the spots where this seems to be affecting people the most is at the gas pump. So, President Joe Biden is trying pretty hard to get those prices down.

- One of the ways he’s doing this is by tapping into the Strategic Petroleum Reserve (SPR) and releasing 50 million barrels of crude oil into the market.

- On Tuesday at the White House, Biden said, “Today we’re launching a major effort to moderate the price of oil, an effort that will span the globe and ultimately reach your corner gas station … It will take time, but before long you should see the price of gas drop where you fill up your tank.”

Hold on, what’s the Strategic Petroleum Reserve?

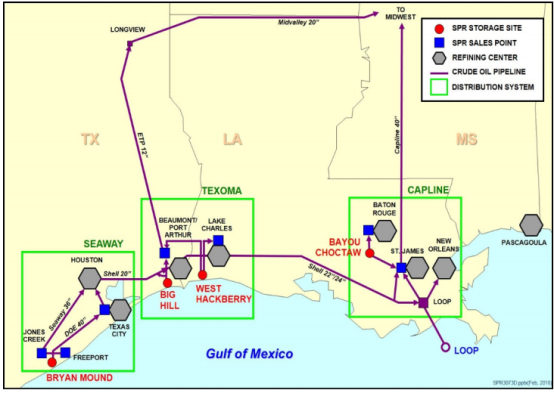

- The SPR is basically like an emergency fund for oil. These giant oil containers are located along the coastline in Texas and Louisiana.

- The point of it is to sit there pretty much and do nothing unless the US finds itself low on oil and in need of a boost, at which point the president can authorize some of that oil to be released into the market.

- This reserve started back in the 70s when a group of Arab oil-producing countries placed an embargo against countries, including the US.

- The US suddenly wasn’t able to get as much oil imported as it was used to, so the oil prices skyrocketed in the country as well as globally.

- So after that situation, in 1975, Congress passed something called the Energy Policy and Conservation Act, which created the SPR and gave the president the power to use it at their discretion so that the country would have a plan B if it ever ran into that situation again.

How does selling oil help inflation?

- Well, there are really only two things that can cause inflation – demand-side pressures or supply side, otherwise known as cost-push inflation. This is the type of inflation that is caused by a rise in the prices of the things businesses need in order to create goods or services.

- This includes worker wages, and you guessed it, oil and gas.

- So the idea is now because low supply is what is causing the rise in the cost of making things for businesses, which is pushing up inflation, by releasing some oil from the SPR and increasing supply, gas prices should go down.

- In fact, the US isn’t the only country doing this. Britain is authorizing the release of 1.5 million barrels, while India is authorizing another five million.

- Some estimate that South Korea and Japan will both release between four and five million barrels, but neither has given specific amounts yet. And, on Wednesday, China said it was working on its own reserves release.

Is it going to work?

- Whether or not it will work remains to be seen, but Biden also made some additional clarifications.

- The president has pushed for a clean energy plan as a part of his agenda, but he assured the public on Tuesday that these climate ambitions weren’t causing the hike in gas prices. “My effort to fight climate change is not raising the price of gas.”

- He has also asked the Federal Trade Commission (FTC) – a government agency meant to prevent unfair business practices – to see whether large oil companies were engaging in “potentially illegal conduct.”

- “Usually, prices at the pump correspond to movements in the price of unfinished gasoline,“ Biden wrote in a letter to Lina Khan, the chairperson of the FTC. “But in the last month the price of unfinished gasoline is down more than 5 percent while gas prices at the pump are up 3 percent.”

- But regardless, Biden’s decision to tap into the SPR has gotten some praise. Senate Majority Leader Chuck Schumer tweeted out his approval on Tuesday, calling it “Good news for families.”

- But some traders have said that this still isn’t enough, and that they were expecting closer to 100 million barrels of oil being released instead of the 50 million that Biden authorized.

- And, according to JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon earlier this week, “I don’t think oil prices are going down."

What’s next?

- Well, the real question is going to be if this solves some of the inflation issues the US is facing, but as Biden said, it won’t happen overnight.

- This oil release is split up into two parts. The first part, 18 million barrels worth of oil, is just an expedited sale of oil that would have been sold anyway.

- But the second part, 32 million barrels worth of oil, is set to take place as a loan to oil companies over the next few months so that they can sell that reserve straight away and ease some of the existing supply strains to help ease inflation.

You drive the stories at TMS. DM us which headline you want us to explain, or email us.

Comments ()