After a sharp sell-off, wiping US$200 billion in value in 3 days, Chinese stocks in the US are soaring – here’s why

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

US-listed Chinese stocks saw hundreds of billions wiped off in market value in just a few days after Russia reportedly asked China for help with the Ukraine war, scaring investors that Chinese companies would be on the receiving end of Western sanctions. But now, they’re roaring back because the Chinese government put a stop to the sell-off and eased our worries by saying that they would be friendlier to markets. There also seemed to be progress made in peace talks between Ukraine and Russia, giving us all hope that there may soon be light at the end of the tunnel.

Key comments:

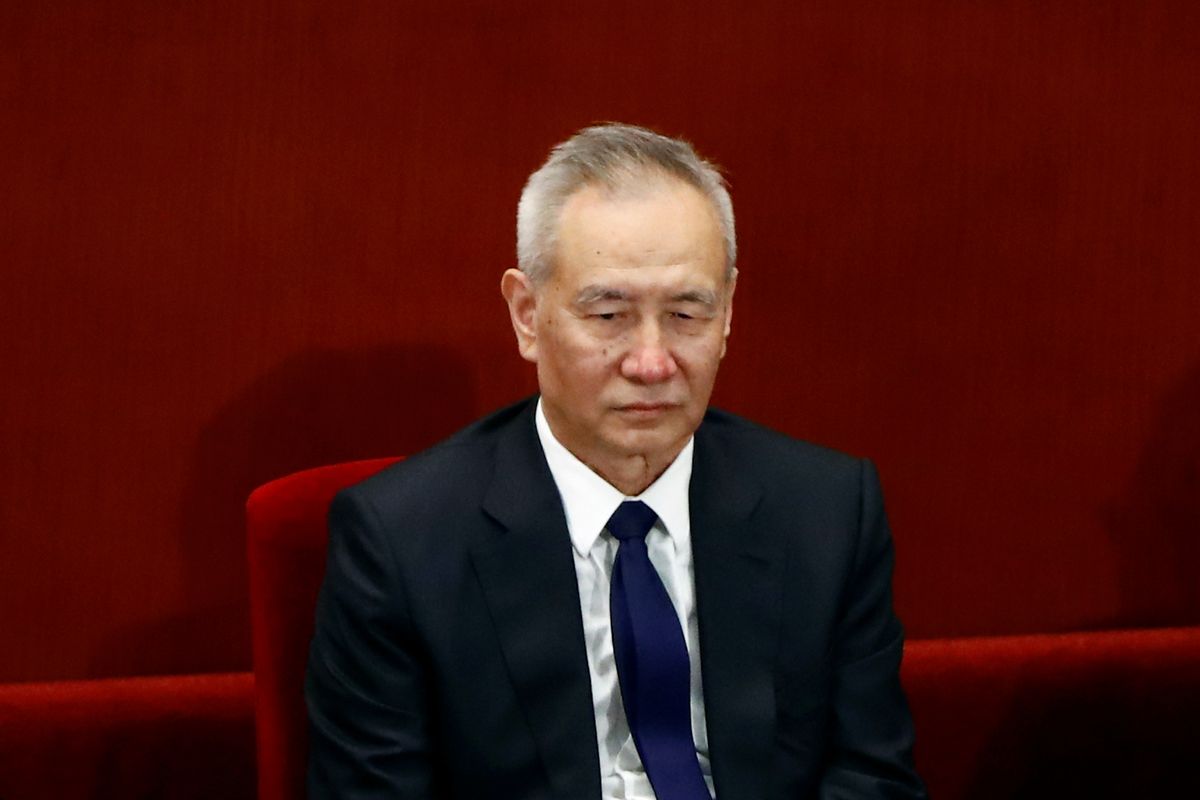

The government should “actively introduce policies that benefit markets,” according to a report from China’s official Xinhua news agency following a meeting of the country’s top financial policy committee led by Vice Premier Liu He.

“What we saw today is the regulatory risk premiums going away. Regulatory risk was the biggest worry for investors and they are right now breathing a sigh of relief on Beijing’s speech. However, it still leaves the geopolitical risk out there, that’s something that has to play out but that usually takes a little bit longer,” said Olivier d’Assier, head of Asia Pacific applied research at Qontigo.

You drive the stories at TMS. DM us which headline you want us to explain, or email us.

Comments ()