With inflation forecast at 60%, Sri Lanka will stop printing cash

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

Sri Lanka is in the middle of an economic crisis with eye-watering high levels of inflation and usable foreign reserves at a low. This comes after the country failed to make payment on a foreign debt for the first time in its history in May and while it’s struggling to buy fuel, with suppliers saying it still owed them money for previous shipments. Now, people familiar with talks have said that India, for example, won’t sell fuel to the country unless it gets payment in advance.

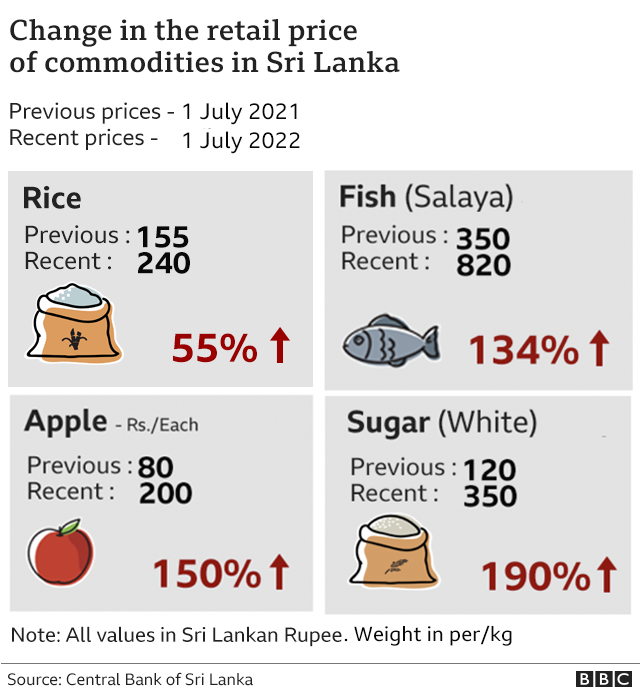

With that, residents have been told to stay at home, and sales of fuel for private vehicles have been temporarily banned. 70% of the nation’s families have cut down on food due to tight supplies and soaring prices. Now, the United Nations Children’s Fund (UNICEF) has said Sri Lanka is on the edge of a humanitarian crisis.

With this, the country has announced that it aims to stop pumping cash into its economy to try and reign in the soaring high inflation, which is forecasted to reach 60%. A monetary policy review is scheduled for Thursday, and the country is still in talks with the IMF for a bailout program as a bankrupt state.

Key comments:

“Families can’t buy what they used to buy. They are cutting down on meals, they are cutting down on nutritious food. So we are definitely getting into a situation where malnutrition is a major concern. We’re trying to avoid a humanitarian crisis. We’re not yet at children dying, which is good, but we need to get the support very urgently to avoid that," said Christian Skoog, UNICEF’s representative in Sri Lanka.

“We will have to face difficulties in 2023 as well. This is the truth. This is the reality. We are now participating in the negotiations [with the IMF] as a bankrupt country," said Prime Minister Ranil Wickremesinghe to Parliament on Tuesday.

Comments ()