Tech favorite Silicon Valley Bank goes bust in 48 hours

Founded in 1983, Silicon Valley Bank was a key player in the tech startup world.

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

The backstory: Founded in 1983, Silicon Valley Bank (SVB) was a key player in the tech startup world. In fact, it had financed nearly half of all US venture-backed tech and healthcare companies – an impressive feat for a bank that was relatively unknown outside of the Silicon Valley bubble. The bank was also ranked among the top 20 commercial banks in the US, boasting US$209 billion in total assets at the end of last year.

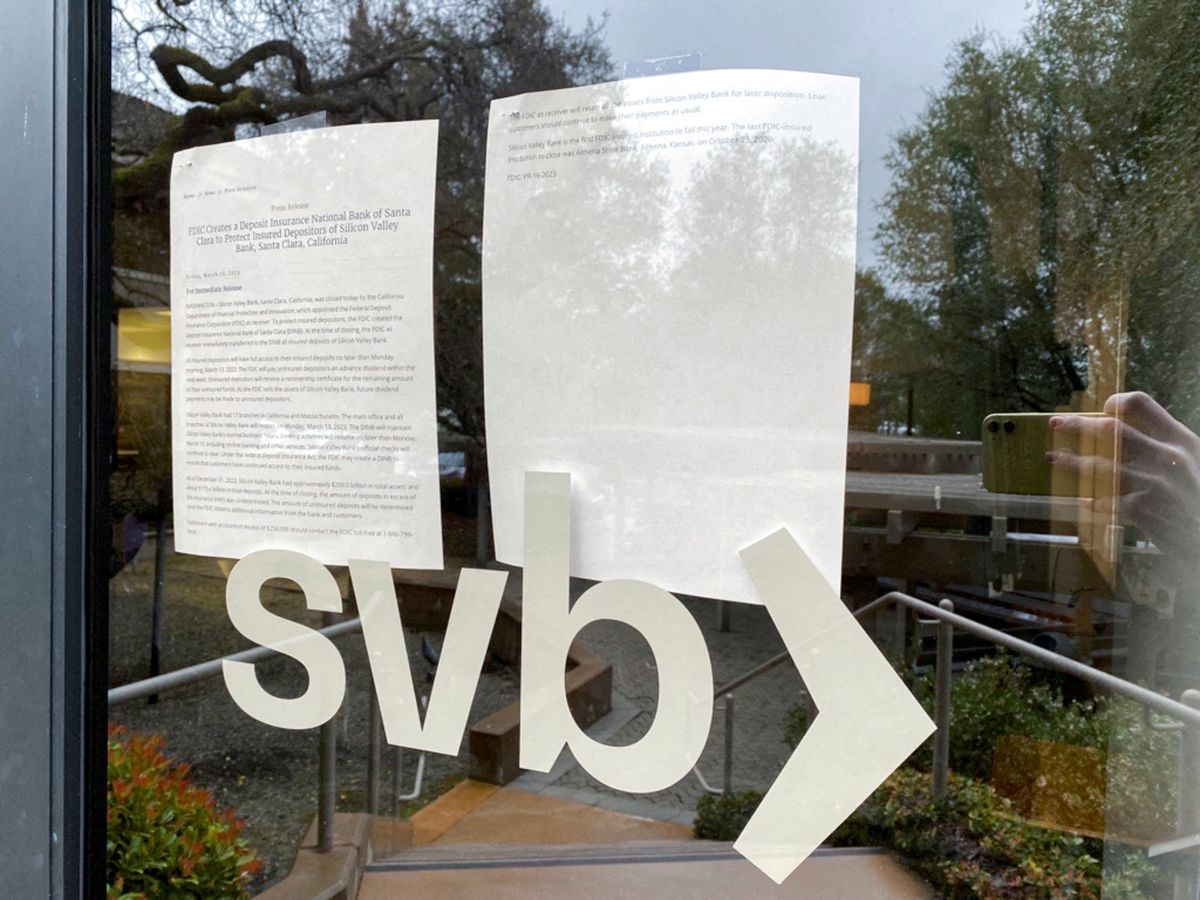

So, what's the news for SVB? Well, this go-to bank for tech startups has gone belly up. It crumbled after a sudden bank run and capital crisis. This event marks the largest collapse of a US bank since the infamous 2008 financial crisis.

More recently: Things started getting sticky for SVB when the Fed raised interest rates to combat inflation, resulting in higher borrowing costs. This put a damper on tech stocks that helped SVB out. On top of that, SVB's bond portfolio worth US$21 billion was sold off to raise cash – at a US$1.8 billion loss.

The development: On Wednesday, the final straw came when SVB announced it needed to raise US$2.25 billion to help balance its books following the loss. This caused a panic among venture capital firms, who began telling their clients to pull their money out of SVB. On Thursday, the bank's stock plummeted around 80% into extended trade hours amid the panic, and customers withdrew around US$42 billion by the end of the day. Things went downhill pretty fast from there for the 40-year-old bank.

On Friday morning, trading in SVB shares was halted, and California regulators had to step in and shut down the bank, placing it in receivership under the Federal Deposit Insurance Corporation (FDIC). The FDIC insures deposits up to US$250,000, but whether clients will get more than this or all of their money back depends on what is made liquidating the bank's assets or if another bank buys what's left.

Key comments:

"Silicon Valley Bank has been a trusted and long-time partner to the venture capital industry and our founders," wrote a statement signed by over 100 venture capital and investing firms to support SVB. "For forty years, it has been an important platform that played a pivotal role in serving the startup community and supporting the innovation economy in the US."

"They really developed a niche that was the envy of the banking space," said Jared Shaw, a senior analyst at Wells Fargo. "They are able to provide all the products and services any of these sophisticated technology companies, as well as these sophisticated venture capital and private equity funds, would need."

"The system is as well-capitalized and liquid as it has ever been," said Moody's chief economist Mark Zandi. "The banks that are now in trouble are much too small to be a meaningful threat to the broader system."

"The reach into Silicon Valley is at the high level," said Louis Lehot, a partner at Foley & Lardner, a legal firm with expertise in guiding startups and public companies, has stated that a huge number of bank clients will be impacted by the situation. "It's deep and broad at all levels of the ecosystem from big companies to startups to VCs, private equity firms and everything in between."

Comments ()