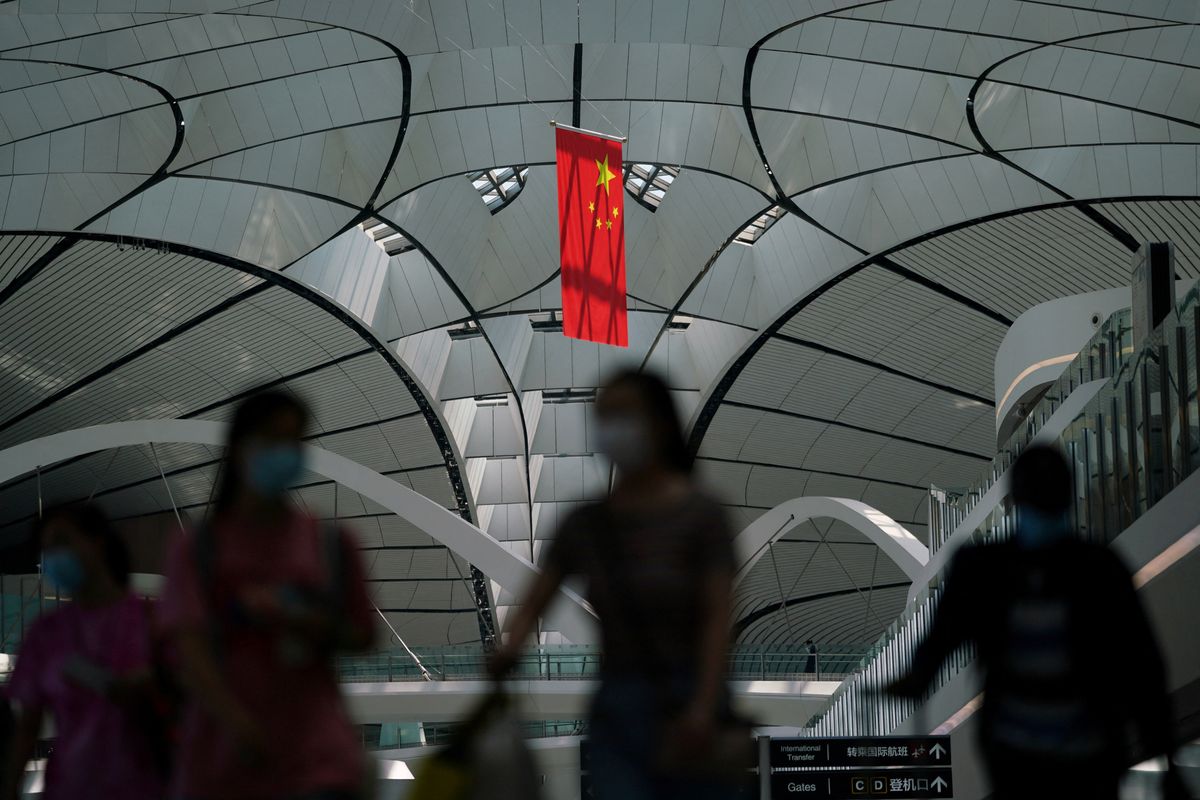

China's massive bailout of developing countries

China has become the biggest lender for developing countries on the planet.

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

The backstory: China has become the biggest lender for developing countries on the planet. This is all thanks to its "Belt and Road" initiative, which has seen China invest billions of dollars into infrastructure projects across the globe. But this has worried Western countries and multilateral lenders about the debt burden on those economies. So they've called on China to give those countries some relief and help with their debt burden.

More recently: In January, a study from Boston University's Global Development Policy Center found that China's two biggest trade policy banks, China EximBank and CBD, had been lending much less money in 2021. In fact, the loans hit a 13-year low of just US$3.7 billion. This is because Beijing scaled back on funding for big oil projects.

The development: A new report from the World Bank, Harvard Kennedy School, AidData and the Kiel Institute for the World Economy found that China has spent a massive US$240 billion bailing out 22 developing countries from 2008 to 2021. Most of the lending (about 80%) happened between 2016 and 2021, with the money going to middle-income countries like Argentina, Mongolia and Pakistan, who used it to build "Belt and Road" infrastructure. But these countries have struggled to repay them.

The report highlighted that China has been giving more loans to countries in debt distress. In fact, in 2022, 60% of its overseas lending portfolio went to these types of countries. That's a huge increase from less than 5% in 2010. Argentina is at the top of the list for getting the most Chinese loans, with a whopping US$111.8 billion. Pakistan comes in second with US$48.5 billion, followed by Egypt with US$15.6 billion.

Key comments:

"Beijing is ultimately trying to rescue its own banks. That's why it has gotten into the risky business of international bailout lending," said Carmen Reinhart, a former World Bank chief economist and one of the study's authors.

"China acts in accordance with market laws and international rules, respects the will of relevant countries, has never forced any party to borrow money, has never forced any country to pay, will not attach any political conditions to loan agreements, and does not seek any political self-interest," said Mao Ning foreign ministry spokesperson at a news conference on Tuesday.

"China's domestic priorities beyond COVID-19 are still significant, given the large amounts of debt and the swings in renminbi that may necessitate the need to be conservative with dollar holdings so they can serve as insurance on the home front," said Kevin Gallagher, director of the university's Global Development Policy Center, to Reuters.

Comments ()