Who’s buying Russia’s gold bars now?

Russia, according to the World Gold Council, has been the largest buyer of bullion in recent years.

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

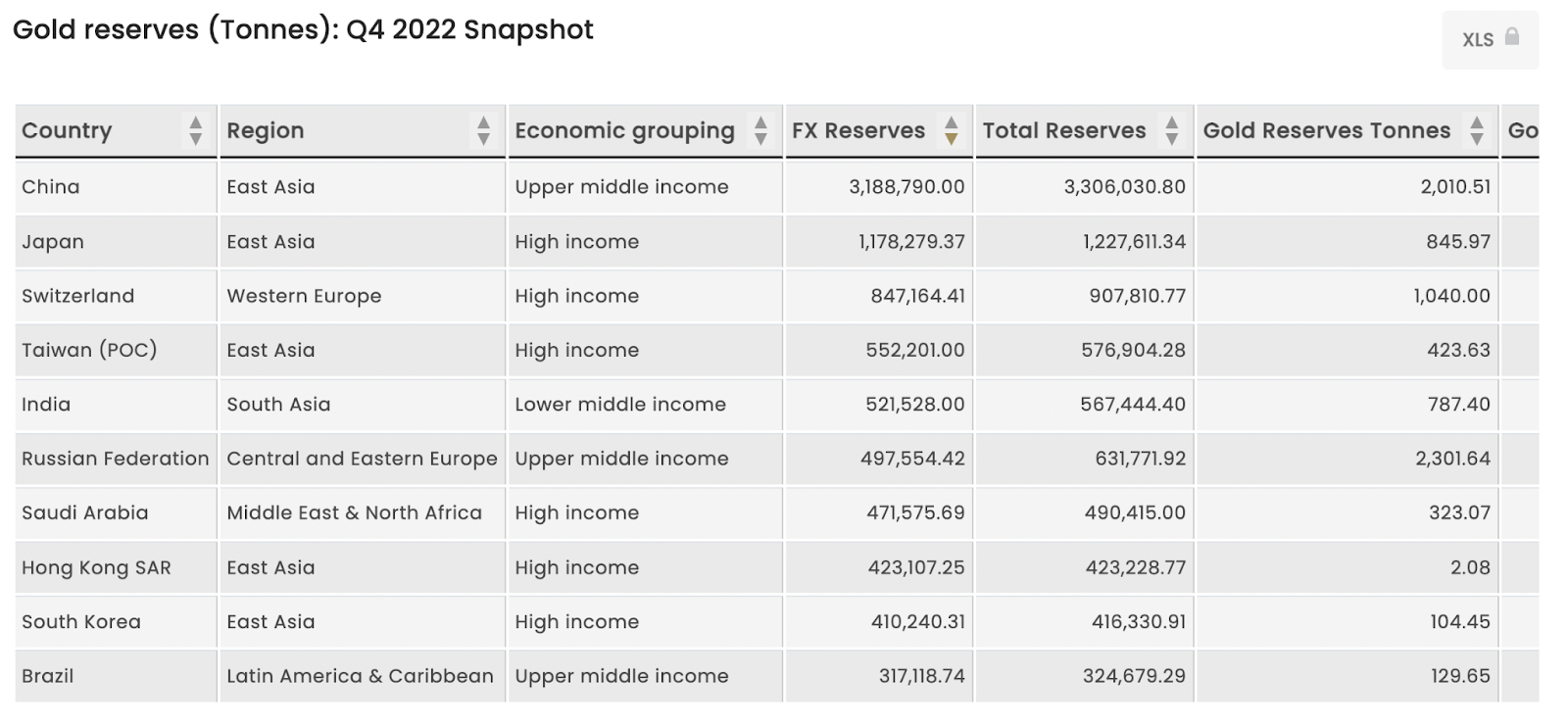

The backstory: You know those gold bars, aka bullion? These are typically over 99% pure and used to store wealth, especially during rougher economic or political times. Well, Russia, according to the World Gold Council, has been the largest buyer of bullion in recent years. It’s also the second-largest miner of gold in the world. As of this April, the country’s gold reserves have been at about 2,300 metric tons, most of which is actual, physical gold.

Now, with the Western sanctions on Russia’s foreign exchange reserves, this has also driven increased gold bar holding among the central banks and Russian citizens. This is especially as the local market struggles to absorb the US$20 billion of metal produced every year. So with central banks already taking some and Russian buyers grabbing some, the industry is looking for foreign buyers for the rest.

In the past 10 years, a lot of this would go to the UK, with Britain buying around US$15.2 billion worth of Russian gold in 2021, according to Comtrade. The gold would then sit in vaults in banking giants like JPMorgan. But now, with G7 and EU sanctions in place, this has meant that this gold has to find a different home.

The development: With no secondary sanctions in place, Russian gold is now being exported piecemeal to regions without any restrictions, including Hong Kong, Istanbul and Dubai. According to ImportGenius, VPower Finance Security in Hong Kong, which deals in cash and gold shipments for large Chinese banks, handled more than US$300 million of Russian gold shipments between March to August last year through the city.

Key comments:

“One of the more significant updates for February came from the Central Bank of Russia, which published its gold reserves for the first time in over a year. It reported gold holdings of 2,330t at the end of February 2023, 31t more than at the end of January 2022 when it last reported. However, no indication was given on the exact timing of the gold purchases over this period so we have assigned the reported change to February until more information is available. Based on the new information, gold reserves now account for 24% of Russia’s international reserves,” writes Krishan Gopaul, senior analyst at EMEA World Gold Council.

"Gold was a good protective financial solution last year," said Yevgeny Beresnev from VTB's investment products department. "Customers shifted funds into this instrument in order to diversify their assets and make a profit when long-term planning."

Comments ()