What's behind China's decision to restrict iPhones?

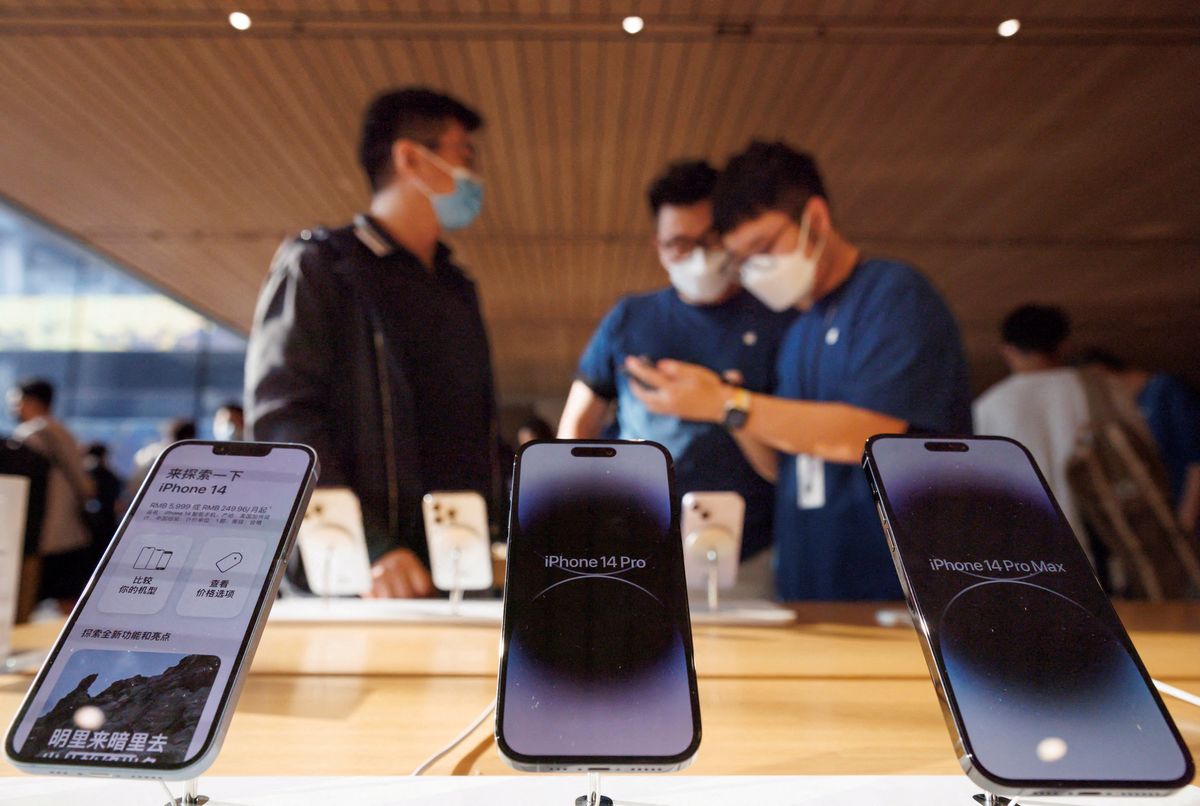

China has taken a big step by telling central government employees to stop using iPhones during work hours.

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

The backstory: China is an important market for Apple, ranking as the tech giant's third-largest globally, right behind the Americas and Europe. Earlier this year, something caught everyone's attention in the tech world. Third-party retailers in the country decided to offer unexpected discounts on Apple's iPhone 14 Pro, slashing prices by up to 10%, to boost a sluggish phone demand. Although those deals helped raise sales of Apple devices, they also brought questions about how they might affect the company’s upcoming product launches.

Zooming out, geopolitics is also an issue. The US has been working to limit China's access to crucial technology, especially cutting-edge chips. On top of that, two major Chinese tech players, Huawei and SMIC, have been sanctioned over concerns about the military applications of advanced chip technology.

On the flip side, China has been working to reduce its dependence on American tech. Back in 2019, the US blacklisted Huawei, dealing a big blow to its global smartphone business. But with support from the Chinese government, Huawei bounced back and played a role in China's quest for technological independence.

High-ranking US officials, including Treasury Secretary Janet Yellen and Secretary of State Antony Blinken, have visited China to ease tensions, but things are still pretty touch-and-go.

More recently: In August, Huawei reported its third consecutive quarter of revenue growth. This was fueled by expansion into new sectors, like cloud computing, and strong smartphone sales. It also began setting up chip factories, sidestepping previous US sanctions limiting chip access.

In the same month, the mobile giant introduced the Mate 60 and Mate 60 Pro, followed by the Mate X5 (a new foldable phone) and the Mate 60 Pro+ just last week. The starting price of the Mate 60, at 5,999 yuan (US$817.70), put it in direct competition with Apple's iPhone 14 in China.

This launch sent shockwaves through the Chinese chipmaking industry, with experts saying the chips used in the phones signaled a tech breakthrough when it comes to domestically produced chips. It also caught the eye of the US Commerce Department, which expressed concerns about whether this new Huawei chip complied with trade restrictions.

The development: China has taken a big step by telling central government employees to stop using iPhones during work hours. This is part of a broader crackdown on the use of Apple devices by state workers, signaling heightened tensions between the US and China, as well as increased competition from Huawei.

According to sources speaking to Reuters, employees in some ministries and government bodies were instructed to put away their iPhones. They were also offered subsidies ranging from 100 to 200 yuan (US$13-$26) to switch to locally-made smartphone brands. While the scale of the ban isn’t clear, experts at Bank of America estimated that it could potentially lead to a 5 to 10 million unit drop in annual iPhone sales in China, a big chunk of the usual 50 million units sold per year.

Key comments:

"This chip likely could not be produced without US technology, and thus SMIC may have violated the Department of Commerce’s Foreign Direct Product Rule," said US Representative Mike Gallagher in a statement. "The time has come to end all U.S. technology exports to both Huawei and SMIC to make clear any firm that flouts U.S. law and undermines our national security will be cut off from our technology."

"We believe Huawei's activity this time was well prepared and not sudden," said Ivan Lam, an analyst at Counterpoint. "It can manage the psychological expectations of the target consumer group before Apple's press conference."

"The only way Apple could draw the ire of Beijing is moving supply chains out of China at a pace or to a degree Beijing feels uncomfortable with," said Evercore ISI strategist Neo Wang in a note. "If that is the case, it shouldn't be a surprise for Beijing to punish Apple by playing the 'security' card excessively. It is unclear whether what we are seeing now is part of this."

"We believe the restrictions have the potential to slow Apple's sales growth in China," said D.A. Davidson analyst Tom Forte. "This could provide an additional challenge for the company, as its revenues from China have already been negatively impacted by a challenging macroeconomic environment in that country."

Comments ()