Hong Kongers are flocking to Shenzhen for everything from grocery shopping to dentist appointments.

❓What’s going on?

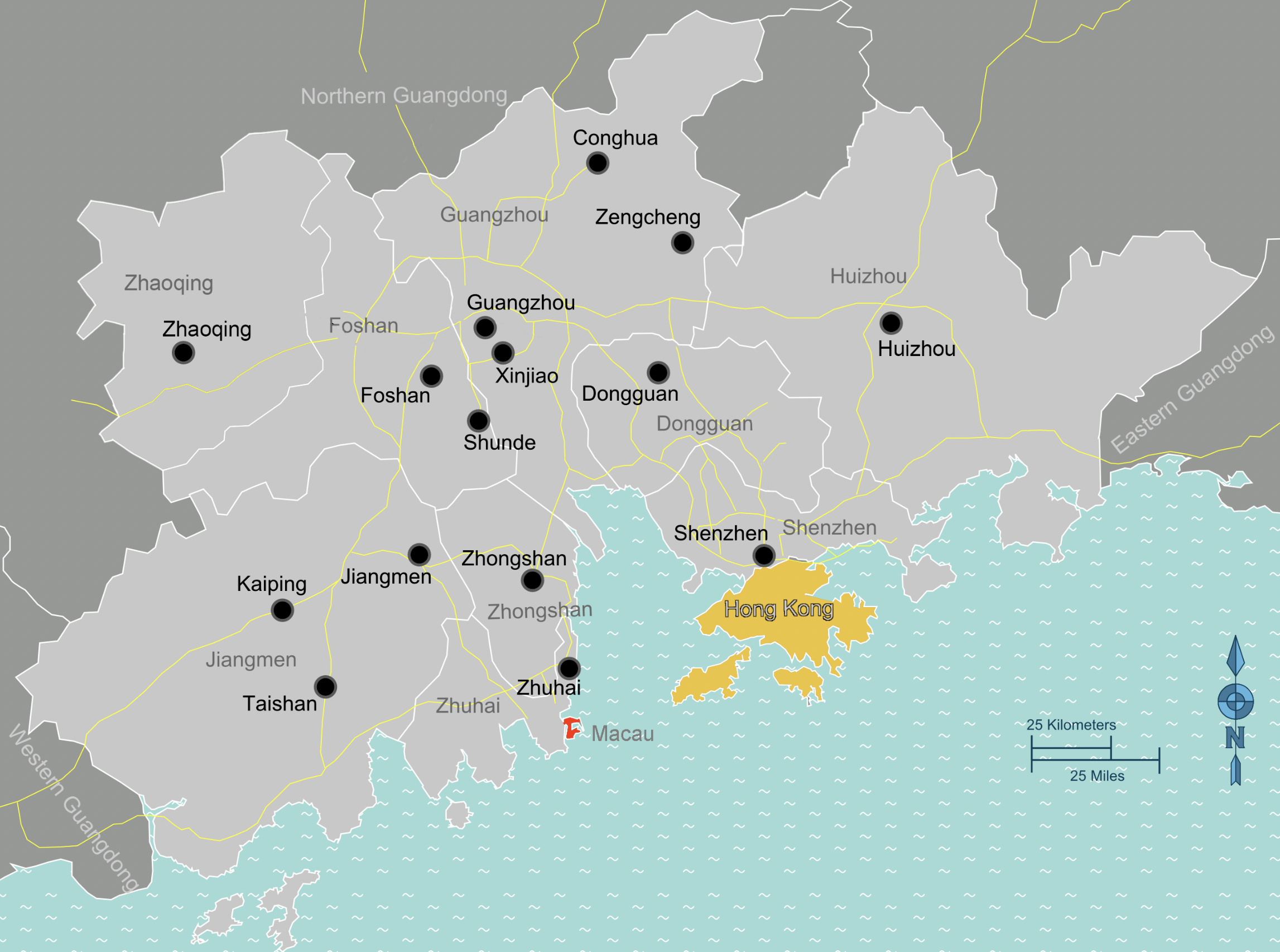

Ever since the mainland opened its borders last year post-pandemic, a new trend has emerged: Hong Kongers are leaving the city for the neighboring Middle Kingdom to “play,” leading to a stronger integration of the Greater Bay Area, or GBA.

In fact, tourists from Hong Kong are forecasted to spend as much as HK$84 billion (US$10.7 billion) in the Guangdong province this year, according to senior economist at Natixis SA Gary Ng. This is close to 15% of the city’s revenue from hospitality, catering and retail combined.

“A growing trend of Hong Kong residents "tripping north" to Shenzhen has been gaining more attention. It’s reflected not only in leisure activities to everyday purchases but also in education and job-seeking to medical services, showcasing a deeper integration between the two regions,” wrote Chinese state media Global Times.

🔢In fact, in line with this trend:

Hong Kong’s Octopus travel card is getting an upgrade. By the end of this month, a new physical card will be launched that can be used in 320 cities in mainland China. The card can be topped up with Hong Kong dollars, and it’ll be automatically charged with the equivalent renminbi for use in the mainland.

Over the Easter weekend, an additional 200 train trips will be added between the Hong Kong West Kowloon Station and Shenzhen’s Futian Station. “We have worked closely with mainland authorities and agreed to enhance services between Hong Kong and Shenzhen, particularly during the Easter holiday," said an MTR spokesperson.

🤔Why is this happening, though?

While the specific numbers vary, it’s mainly because it’s just so much cheaper next door.

🤑For the leisure, short-term trippers:

China’s sluggish economy, coupled with the weak yuan, has meant that those living in Hong Kong have found respite next door. This is an increasingly visible trend, whether it’s for food, grocery shopping or even dentist appointments. On top of that, we're seeing more advertisements in Cantonese, employees required to be bilingual and discounts for those with the +852 area code.

“For four hundred dollars, we could live at a four-star hotel in China, but here, we could only live at a hostel,” said Zhang Ziyue, a tourist from the mainland in Hong Kong, highlighting the drastic cost of living difference between Hong Kong and the mainland.

According to a recent press update from the e-commerce platform SHOPLINE, the company has seen significant growth in cross-border sales. Hong Kong residents have flocked to membership warehouse clubs and mega malls in Shenzhen, such as Sam's Club and Costco, in search of slashed prices and bulk-buy deals.

📈Some of SHOPLINE’s data seen by TMS:

"Sam's Club," "group buying," "personal shopping service" and similar terms have become popular search keywords amongst Hong Kongers in the past three months.

SHOPLINE Hong Kong merchants have even started offering personal shopping services for Hong Kongers looking for Sam's Club products, with electronic appliances being some of the most popular items.

Shenzhen locals now actually joke that Hong Kongers have “occupied” them. Some shops have instructions for how Hong Kongers can use WeChat Pay and AliPay, mainland China’s main two platforms for digital payments. Some stores also allow tourists to pay with Hong Kong dollars without converting them to renminbi.

🌏The bigger picture: A greater integration of the GBA

This is all in line with a bigger plan.

The Guangdong-Hong Kong-Macao Greater Bay Area (GBA) is actually an important part of China’s Belt and Road initiative – an economic plan put in place by the Chinese government to deepen the integration between Asia, Africa and Europe through primarily investments and infrastructure.

According to the government’s Outline Development Plan for the GBA:

“By 2035, the Greater Bay Area should become an economic system and mode of development mainly supported by innovation, with its economic and technological strengths vastly increased and its international competitiveness and influence further strengthened; the markets within the Greater Bay Area should basically be highly connected, with very effective and efficient flow of various resources and factors of production; the coordination of regional development should remarkably improve, with the influence on neighbouring regions further strengthened; the people should become wealthier; the level of social civility should reach new heights, with cultural soft power demonstrably strengthened, Chinese cultural influence broadened and deepened, and exchange and integration between different cultures further enhanced; the levels of conservation and efficient use of resources should be significantly improved, the ecological environment should be effectively protected, and an international first-class bay area for living, working and travelling should be fully developed.”

Specifically, the aim is to create “a quality living circle for living, working and travelling” that benefits all of the residents and businesses within its radius.

🗣️What people are saying:

“Many operators are keenly aware that many HK people are traveling to Shenzhen every week and that the people coming from the mainland are different than pre-pandemic. Many can see more money going out than coming in. Naturally this presents a risk to them. However, I am constantly amazed at the number of people who have not been over to Shenzhen recently to have a look for themselves.

From Admiralty, you can be sitting down to dinner in just over an hour. Yes, there is risk, there is also opportunity. There are 20 million people in short distance from the HK border versus 7 million on this side of the border. I also see operators going across for expansion opportunities or as a way to understand how to target those who are coming across on a very different social media landscape.”

– Liam Collette, Director of Eastern Path Limited, an F&B consulting firm that works with the likes of Doughbros in a comment to TMS.

“Hong Kong-based companies are adopting a GBA strategy to stay relevant as consumer behaviour evolves. Hong Kong local retailers and landlords who suffer from reduced foot traffic in Hong Kong would find good remediation from their GBA presence. Those with a portfolio of outlets in Hong Kong and China will continue to do well.”

– Eric Lin, Head of Greater China Research, UBS Investment Bank, adding that the bank also forecasts China to contribute around 20% of revenue by 2025 to MSCI Hong Kong businesses.

”Eighty-six million people, all within one and a half hours by high-speed rail, which is nothing. In 2024, [the Greater Bay Area] had a GDP of US$1.9 trillion."

– Allan Zeman in an interview with TMS.

Comments ()