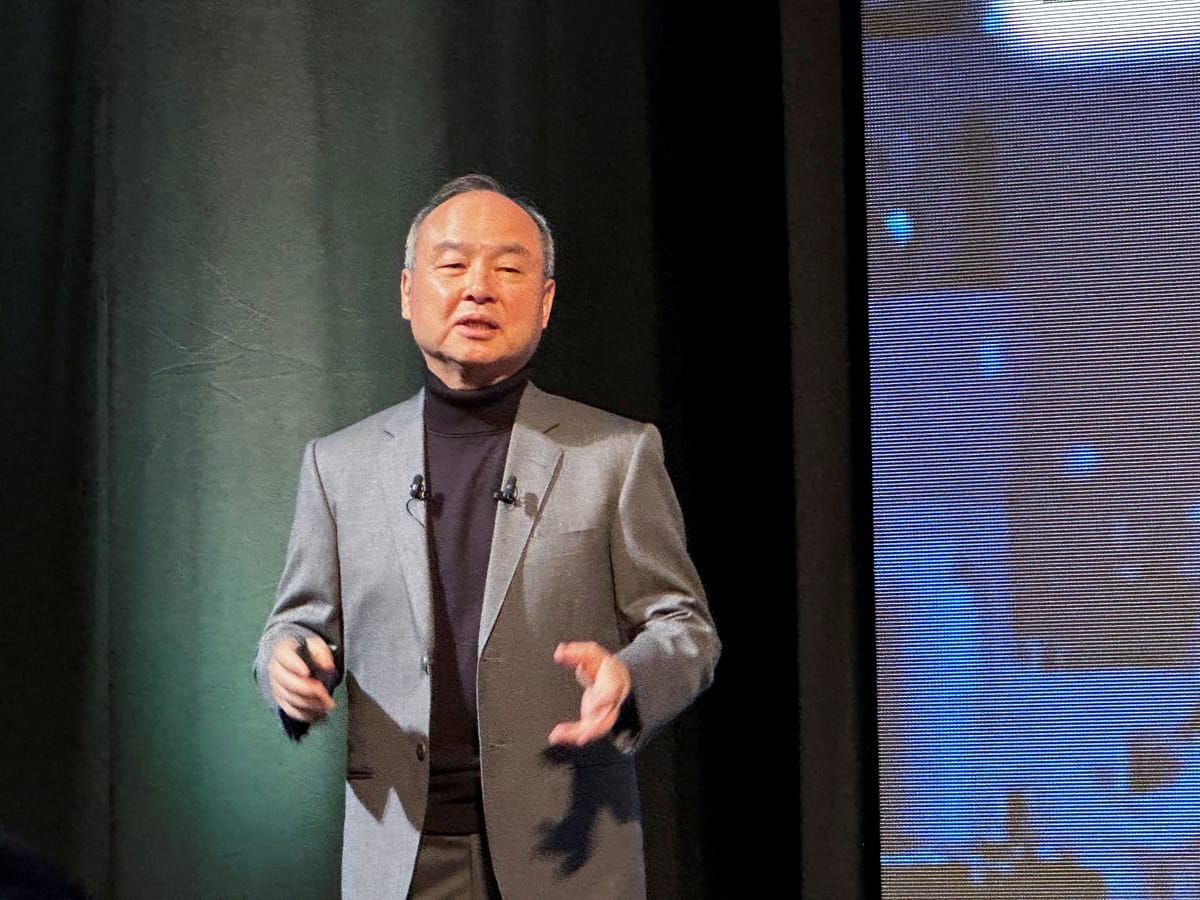

Masayoshi Son is betting big on AI with plans for a Softbank-backed chip venture to rival Nvidia

Son’s Softbank first invested in Alibaba when it was just a startup in 2000. Over the last 23 years, it’s made more than US$70 billion off that bet. Now, Son is turning his eye toward the AI boom.

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

The backstory: Japanese investment company Softbank was founded by Masayoshi Son in 1981. It has invested in many well-known businesses over the years – for example, the flexible workspace company WeWork and Chinese e-commerce giant Alibaba. In 2016, Softbank invested in the UK chip design company Arm. Arm doesn’t actually make semiconductors (aka chips), but instead, it creates the "architecture" or chip designs for companies like Nvidia, Apple, Alphabet and Samsung. Softbank also used to have a US$3.6 billion stake in chipmaker Nvidia, but it dropped all of it in 2019.

Nvidia is one of the world’s top chip suppliers for major tech companies like Amazon, Microsoft, Alphabet, Meta and Dell. This is because the graphics processing units (GPUs) it makes are the best on the market for artificial intelligence (AI). And, as the AI sector booms, businesses everywhere are racing to develop AI technology. But high demand (among other things, like supply chain issues) also led to a shortage of chips and a long waiting list. So, big companies like Meta and Amazon have started creating their own chips.

More recently: Earlier this month, Arm reported its earnings, showing a 14% year-on-year increase in revenue to US$824 million for the third quarter, sending its value to almost US$117 billion. For some context, it was listed in September at around US$55 billion. Nvidia is riding the AI wave, too, beating out Alphabet in market value last Wednesday. Nvidia also reported some of its stakes in other tech companies last week, including a whopping US$147.3 million stake in Arm.

The development: Son’s Softbank first invested in Alibaba when it was just a startup in 2000. Over the last 23 years, it’s made more than US$70 billion off that bet. Now, Son is turning his eye toward the AI boom. He’s considering a new US$100 billion chip venture, as first reported by Bloomberg. Sources said that one possible setup would see Softbank invest US$30 billion in the venture, with US$70 billion possibly coming from investors in the Middle East.

Softbank has a 90% stake in Arm, and with this project (code-named Izanagi), it’s aiming to launch an AI chipmaker that will complement Arm and directly compete with Nvidia. After this announcement, Softbank’s stocks saw a bump of as much as 3.2%. If successful, Izanagi would surpass Microsoft’s investment in OpenAI and would be one of the biggest AI investments since ChatGPT, making up around a fifth of the global semiconductor market.

Key comments:

"AGI is what every AI expert is after, but when you ask them about a detailed definition, a number, the timing, how much computing power, how much smarter AGI is than the human intelligence, most of them don’t have an answer. I have my own answer: I’m convinced AGI will be real in 10 years,” Masayoshi Son said to a group of Japanese enterprise clients in October.

“When you think about artificial general intelligence and what is required to make that happen in terms of compute, power efficiency, energy — those are all great areas for us to be involved in and focused on,” ARM CEO Rene Haas said, noting that he was speaking as Arm CEO, rather than as a SoftBank director.

Comments ()