China welcomes foreign investment to drive growth

China wants to make it easier for foreign investors to join in manufacturing and some services sectors.

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

The backstory: China has been grappling with a slew of challenges, from a troubled real estate sector to high youth unemployment, dwindling exports and mounting local government debt. These issues aren't helped by a slower-than-expected recovery from the COVID pandemic and escalating tensions with the US.

In 2022, Beijing tried to bolster its economy by opening up more sectors. The government did this by removing some from its so-called "negative list for market access," meaning they'd be open to investment by both Chinese and foreign investors. This move allowed major players like Tesla to operate independently in China.

But even though Beijing opened up sectors and relaxed some COVID restrictions at the end of 2022, foreign companies still have some hesitations about doing business in China. Take Hyundai Motor, for instance. The company recently sold off a joint venture plant in Chongqing at a steep discount.

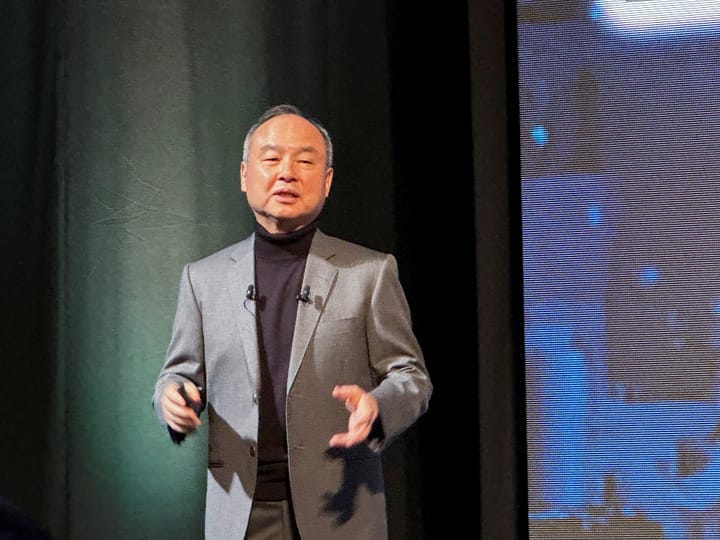

More recently: The manufacturing sector in China has seen a retreat of foreign investors, leading to the first decline in foreign investment in over a decade. According to data from the Ministry of Commerce, overseas companies invested 1.13 trillion yuan (US$157 billion) in China last year. But, during the January World Economic Forum Davos summit, Premier Li Qiang assured everyone that the country remained open for business and encouraged foreign investment.

The development: China's "Two Sessions" are ongoing right now, running from March 5 to March 11 in Beijing. This is where China discusses its future plans and policies. One big focus this year is on becoming more self-reliant and boosting domestic industries like artificial intelligence (AI) and space exploration. China also wants to make it easier for foreign investors to join in manufacturing and some services sectors.

Meanwhile, the National Development and Reform Commission hinted at easing rules in telecom and medical services, but it's keeping some details quiet for now. Premier Li talked about China's goals for 2024, aiming for around 5% GDP growth. He also mentioned updating the negative list for market access again to make it easier for foreign investors to jump into manufacturing.

Key comments:

"Announcements don't move markets and promises don't drive investment," said Sean Stein, chairperson of the Beijing-based American Chamber of Commerce China.

"2024 will be worse," said Alicia Garcia Herrero, chief economist for Asia-Pacific at Natixis. "They would need to fully open many more sectors, eliminate forceful location and close down a few state agencies, but none of that is going to happen, so I think FDI will continue to fall," she added.

"Foreign investors will face major competition from Chinese counterparts, so their investment decisions won't be determined by what the government says, but by the return they receive and their global strategy," said Dan Wang, the chief economist of Hang Seng Bank China.

"No matter how the world changes, China's pace of opening up will never stall and its determination to share development opportunities with the world will never change," said China's Premier Li Qiang last year.

Comments ()