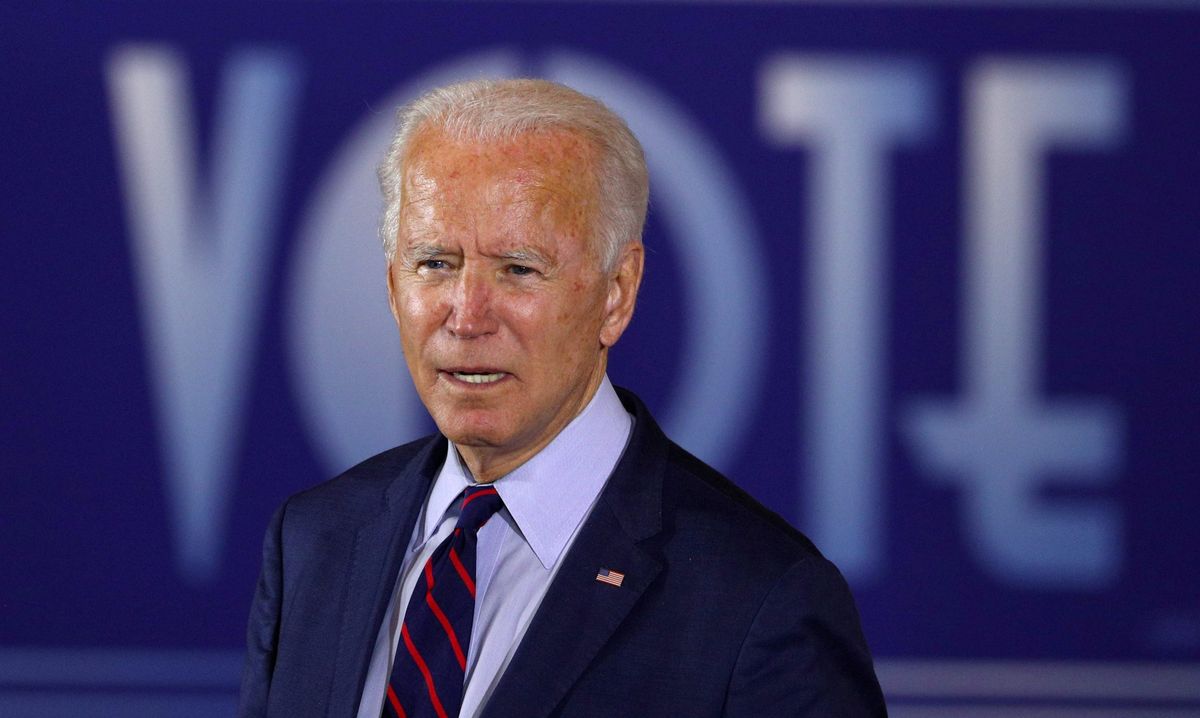

Biden’s tax policy, explained

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

Former Vice President Joe Biden has stated that his administration, if elected, would reverse Trump-era tax cuts, raising taxes on the wealthiest Americans as well as corporations.

With United States debt continuing to rise past record levels, tax policy remains a front-and-center issue leading into the November elections.

Whoever achieves victory in November could set in place two radically different economic platforms, which would see the US and its burgeoning debt chart two very different paths toward the future, in which tax policy plays a central, distinguishing role.

Former Vice President Joe Biden has stated that his administration, if elected, would reverse Trump-era tax cuts, raising taxes on the wealthiest Americans as well as corporations.

Those earning under US$400,000 a year, the Democratic challenger has stated, would not face tax hikes but instead a series of targeted tax credits to improve the lives and livelihoods of working and middle-class Americans.

Biden’s campaign argues that his tax plan “rewards work,” whereas the record set by Republican incumbent President Donald Trump, including the landmark 2017 Tax Cuts and Jobs Act, “rewards wealth.” In response, President Trump has claimed that with Biden’s tax policy, America would “have a depression the likes of which you have never seen.”

With contradicting claims coming from both sides, TMS takes a deeper look at Biden’s proposed tax policy and what it could mean for all Americans.

Taxes under Trump

Under President Trump’s administration, the US has witnessed some of the largest tax breaks for wealthy earners and corporations on record.

The president’s landmark first-term legislation, the Tax Cuts and Jobs Act of 2017, followed the belief that tax cuts for corporations and wealthy individuals would stimulate the economy by allowing these groups to inject more money into wages and investment.

The cuts slashed corporate tax rates from 35% to 21% and top individual income taxes were also reduced to 37%. Corporate tax cuts were made permanent, whereas individual cuts were set to expire after five years time.

Though not the sole contributor, President Trump’s tax cuts have enabled record-breaking levels of federal deficit spending, with total debt currently standing at some US$27 trillion. Even before the impact of the coronavirus pandemic, President Trump had presided over the fastest increase ever of the US debt, due in part to large tax cuts alongside continued high spending.

Biden’s plan

For Democratic challenger Joe Biden’s campaign, these Trump-era tax cuts stand as a symbol of all that was wrong with President Trump’s first term.

According to Tax Policy Center senior fellow Howard Gleckman, “the basic Biden story is if you’re rich or if you’re a corporation, you’re going to pay more tax,” whereas “Trump is basically saying ‘We’re going to cut your taxes,’ and not telling anybody how.”

The Biden campaign website argues that President Trump “relentlessly pursued an economic agenda that rewards wealth over work and favors multinational corporations over small businesses.”

Trump’s 2017 tax cuts formed the crux by which this agenda was pursued, according to Biden’s campaign. The website cites comments made by the president at his Mar-a-Lago residence after signing the bill into law, telling wealthy members “you all just got a lot richer.”

In place of these tax cuts, which Biden’s platform proposes to repeal, the Democratic challenger is proposing a radically different regime.

Biden’s plan calls for a reversal of Trump-era tax cuts by raising the corporate tax rate to 28% (below its 2016 levels pre-Trump tax cuts) and installing a 21% offshore tax rate along with other tax penalties on companies that shift jobs and revenue overseas to avoid taxes.

For high-earning individuals, top individual income tax rates will be raised to 39.6% and those who make US$1 million or more a year will pay the same tax rate on their investment income that they do on their wages.

President Trump and his Republican allies have claimed on numerous occasions that Biden’s tax plan would raise taxes on the vast majority of Americans. During the final presidential debate in October, President Trump claimed that Biden “wants to raise everybody’s taxes” which would cause “a depression the likes of which you have never seen.”

These claims are unfounded. Biden has stated forcefully that he would not raise taxes on individual incomes below US$400,000, but would instead expand a whole-host of new tax benefits. These include tax credits for child care, first-time homebuyers, educational debt relief, retirement savings, access to health insurance and more.

For eligible Americans, Biden’s plan actually proposes lessening the tax burden through these tax credits, which would directly offset the amount of tax these Americans are liable to pay, should they, for instance, need help affording health insurance.

Implications

Biden’s plan does not lay out higher taxes for the vast majority of Americans. But the implications of these tax increases for wealthy individuals and corporations are debated.

Adam Selita, chief executive officer and co-founder of The Debt Relief Company, told TMS that higher corporate tax rates planned by Biden could be passed on to the consumer and average American.

Selita argued that though “Biden’s tax plan may not appear to directly impact working class Americans and their effective tax rate, it will cause corporations and other businesses to raise prices on goods and services,” which means “the tax burden usually does get passed down to American consumers.”

Selita believes, however, that “raising taxes on the wealthy is a lot less likely to impact the middle class as much,” though higher corporate tax rates could prove to be something “that all Americans will feel more in the goods and services we purchase.”

On the other hand, the economist Paul Krugman has argued that replacing Trump-era tax cuts with higher taxes to fuel more government spending will strengthen “the economy in the long run, as well as boosting it over the next few years.”

Likewise, Austan D. Goolsbee, former chief of the White House Council of Economic Advisers in the Obama administration, has argued that the coronavirus crisis has proved to be a “hugely unequal recession,” thus making it justifiable that wealthier individuals and corporations should shoulder a larger tax burden as “many of them have not had a recession at all.”

Conservative critics are not so sure. Kevin Hassett, the former chairman of Trump’s Council of Economic Advisers, has estimated that Biden’s tax plans would cut GDP per capita by 8% over the next decade. The economist Michael R. Strain also believes that raising taxes “in a weak economy with a once-in-a-century pathogen slowing economic activity” is “misguided.”

The nonpartisan Urban-Brookings Tax Policy Center has also estimated that Biden’s tax proposals would raise less revenue in the long-term than previously thought. Before the coronavirus pandemic, it was predicted that Biden’s tax changes would raise an additional US$4 trillion over the next decade.

Now, the Tax Policy Center estimates that the proposals would raise only US$2.4 trillion, nearly US$2 trillion less than original estimates, with a slowdown in the economy as a result of the pandemic largely responsible for this.

For many Americans, taxes will be of secondary importance amid the continued rise in coronavirus cases around the country and personal financial issues more generally.

But depending on which administration occupies the White House at the end of January 2021, the US could witness two radically different tax regimes instituted, each of which is certain to have long-term implications for all Americans and the wider economy in general.

Have a tip or story? Get in touch with our reporters at tips@themilsource.com

Comments ()