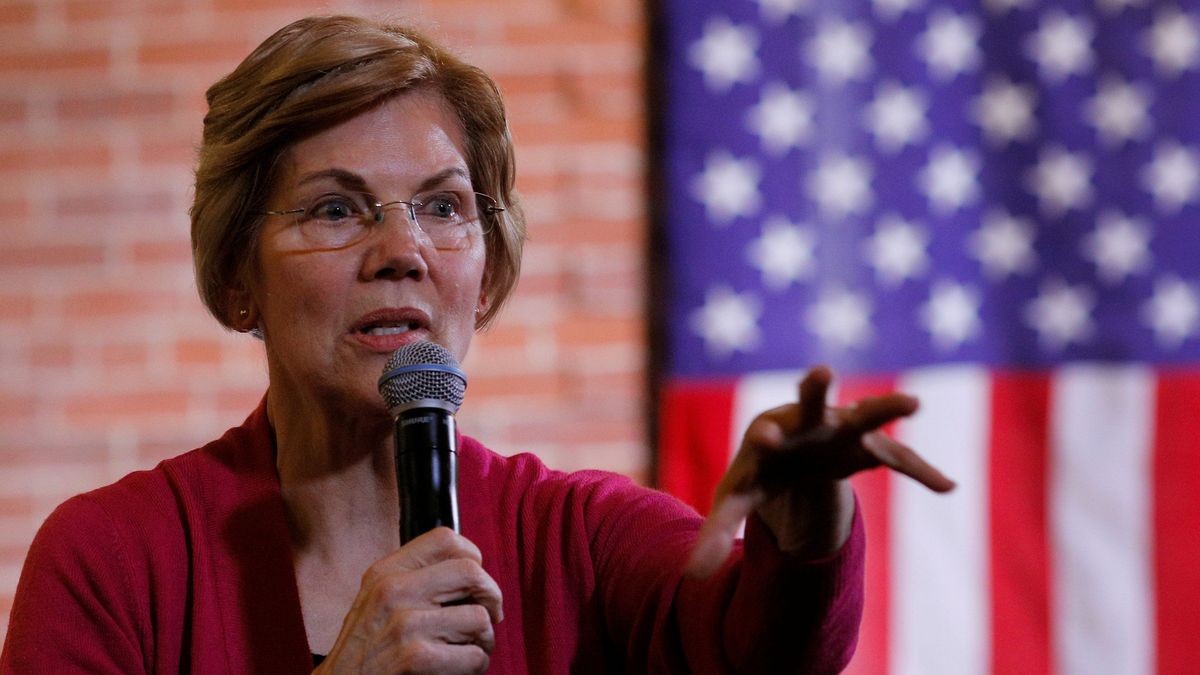

How would Senator Elizabeth Warren’s 2% wealth tax work?

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

A tax on the rich is broadly supported by most Americans, yet, Warren’s wealth tax is certain to face resistance in the evenly split Senate.

As one of the Senate’s most progressive voices, Massachusetts Senator Elizabeth Warren has long been an advocate for systemic financial reform and ensuring the wealthy “pay their fair share.” With the Ultra-Millionaire Tax Act, which Warren has proposed along with United States Representatives Pramila Jayapal and Brendan Boyle, the senator is looking to turn her politics into policy.

Generally referred to as a “wealth tax,” the proposed act would impose a 2% tax on the nation’s wealthiest individuals. It has been estimated that the tax could raise as much as US$3 trillion over a decade. Increasing taxes on America’s wealthiest citizens was one of Warren’s policy proposals during her ultimately unsuccessful 2020 campaign to win the Democratic nomination for president.

A tax on the rich is broadly supported by most Americans, yet, Warren’s wealth tax is certain to face resistance in the evenly split Senate. Even if all 50 Democrats got behind the bill, it would still not necessarily pass unless President Joe Biden changes his position on the issue.

What is Elizabeth Warren’s wealth tax?

On March 1, Senator Warren released the details of her proposed wealth tax plan. As Warren’s press release states, the Ultra-Millionaire Tax Act boils down to a two-pronged tax initiative:

· A 2% annual tax on the net worth of households and trusts between US$50 million and US$1 billion

· A 1% annual surtax (3% tax overall) on the net worth of households and trusts above US$1 billion

Per the press release, this tax would only affect .05% of the country, or 100,000 American households. A study of the proposed tax plan by economists Emmanuel Saez and Gabriel Zucman at the University of California in Berkeley found it would “raise around $3.0 trillion over the ten-year budget window 2023-2032, of which $0.4 trillion would come from the billionaire 1% surtax.”

Warren also discussed the proposed bill in a thread on Twitter. She explained that, with Jayapal and Boyle, she was “introducing a bill for a two-cent #WealthTax on net worths above $50 million—a few cents more for billionaires. This will raise at least $3 trillion to #BuildBackBetter and increase opportunity for all.”

Warren’s thread also laid out the rationale for the tax: “Right now, we live in an America tilted toward the ultra-rich and the powerful. The tax system is so full of loopholes and special breaks that families in the top 0.1% pay about 3.2% of their wealth in taxes while the bottom 99% pay about 7.2% in taxes.”

The senator concluded the thread by stating, “This is one way we can make this government work for everyone—not just the rich and powerful.”

The math of Warren’s wealth tax

According to a review of the proposed tax bill published by Bloomberg News, the richest 100 Americans would pay US$78 billion in annual taxes if the bill were to pass. At the top of the list is Jeff Bezos, the former Amazon chief executive officer and world’s richest person, who would pay “at least $5.4 billion in 2021 if the bill became law.” Tesla and SpaceX CEO Elon Musk would pay US$5.2 billion.

While US$78 billion is a substantial amount, it’s compared to the US$598 billion the top 100 Americans gained in 2020 on top of their existing wealth. That represents a 13% tax on the increase in wealth, but not on the total wealth that those individuals have.

Per the most recent Forbes 400 list, published last September, the richest 100 Americans have a combined net worth of over US$2.1 trillion. US$78 billion would be roughly 3.7% of that amount. In 2020, everyone in the top 100 had at least US$6 billion, with Bezos having US$179 billion.

Since September, those numbers have gone up. The Bloomberg Billionaires Index, which has seen Bezos and Musk exchange the title of “the richest man in the world” a couple times in the last year, puts Bezos’ current worth at US$182 billion and Musk’s at US$177 billion.

Will Warren’s wealth tax pass?

The discussion might be a moot point, though. As the Bloomberg assessment of the wealth tax puts it, “Warren’s proposal is unlikely to go anywhere in a narrowly divided Congress.”

Increasing taxes on the rich is a consistently popular policy position. In January 2020, a Reuters/Ipsos poll found 64% of respondents strongly or somewhat agreed that “the very rich should contribute an extra share of their total wealth each year to support public programs.” Support was stronger among Democrats (77%), but even 53% of Republicans agreed.

A December 2020 poll by The New York Times and Survey Monkey found similar results: “Two-thirds of Americans (67%) support raising taxes on those making $400,000 or more while keeping tax rates at current levels for anyone making under that amount.” The breakdown included 88% support from Democrats, 70% from independent voters and 45% from Republicans.

In the Senate, though, that partisan divide is far greater. 2019 polling on the issue found the one group that opposed a wealth tax was college-educated Republicans. Among that group is every Republican member of the Senate. No GOP senators are expected to support Warren’s bill.

While Democrats have enough of a margin in the House of Representatives to pass the bill, in the Senate, which is split 50/50 between the two parties, passage is not expected. That’s in part because President Biden has previously rejected progressives’ call for a wealth tax.

Biden’s own tax plan would reverse the Trump-era tax cuts for the wealthy and would increase taxes on corporations. It would also increase the tax rate for wealthy Americans, but it would not levy a separate tax on high earners and would, therefore, take in far less than Warren’s plan.

Without the support of the Biden administration, which would need to give its blessing for Vice President Kamala Harris to provide a tiebreaking vote in the Senate, Warren’s wealth tax may be dead in the water.

Have a tip or story? Get in touch with our reporters at tips@themilsource.com

Comments ()