The 5 best checking accounts in 2021

A few minutes every morning is all you need.

Stay up to date on the world's Headlines and Human Stories. It's fun, it's factual, it's fluff-free.

The financial world is moving toward complete digital currency and doing it very quickly. As a result, few people carry cash anymore. Every purchase or transaction is made using a plastic card or the digital equivalent on a smartphone. Whichever mode is used, that payment is usually linked to a personal checking account.

The checking account options in today’s world are endless, but not all checking accounts work for you. The checking account you use shouldn’t be just a receptacle for your income and revenue streams.

Your checking account should help grow your money too. There are a number of options available, but a few top the list of best checking accounts this year.

Each account offers different options and benefits to fit your needs. Not just that, but some checking accounts offer even more benefits like getting quality car insurance with a checking account.

The top checking accounts in 2021

The best checking accounts of this still very new year offer a number of great benefits and advantages to individuals who use them. The biggest benefit is each account listed is available nationally, so location isn’t a roadblock to better banking.

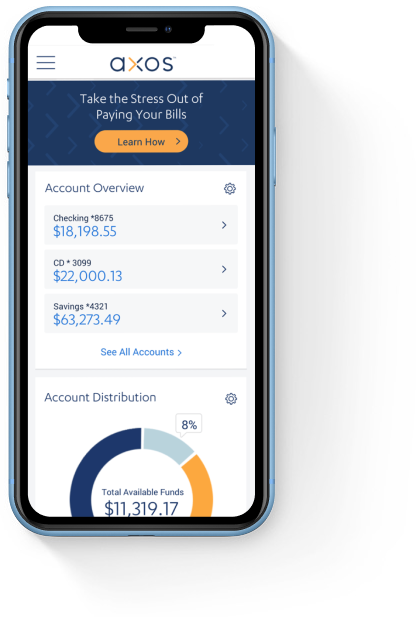

AXOS Bank Rewards Checking

AXOS is a completely digital bank that offers quality products and services with high levels of security and privacy. A digital bank like AXOS helps streamline banking processes and offers total access to your accounts without worrying about time or location.

The Rewards Checking account offers many benefits to the consumer and keeps maintenance or recurring costs low. This checking account provides the consumer with an annual percentage yield of up to 1.25%. This means the money you put into this account earns you more money.

In addition, there is no monthly maintenance fee or minimum balance required. You have full access to your account and will see a little boost in your bottom line.

Consumers Credit Union Rewards Checking

Consumers Credit Union is based out of Michigan. If you are located outside the Michigan area, you will still have access to the online functions of this financial center. Don’t let the location keep you from reaping the benefits of such a great checking account.

The Rewards Checking account offers one of the higher annual percentage yields (APYs) of the checking accounts listed. This account offers 2.09% to 4.09% on all balances up to US$10,000.

The exact APY you will be offered depends on a number of factors, but it will fall within this range. The Rewards Checking account also boasts no monthly maintenance fee or minimum balance requirement.

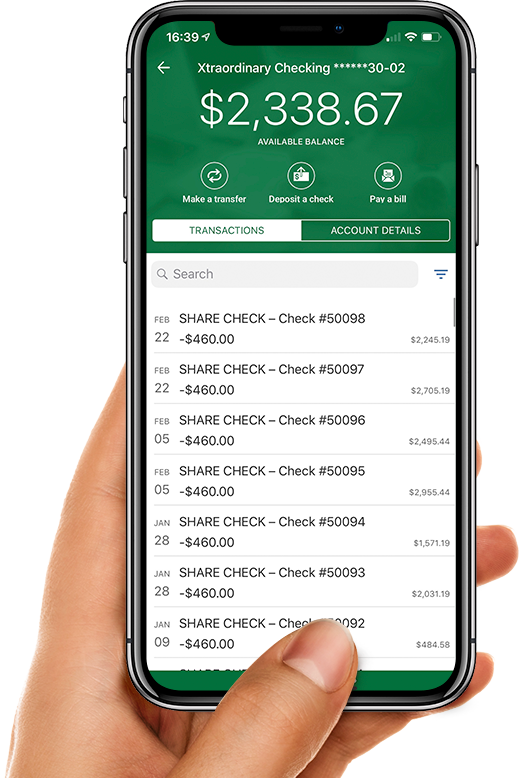

Connexus Credit Union Xtraordinary Checking

Connexus Credit Union is a fully digital banking institution. It offers a full range of products all accessible without leaving the comfort of your own home. It also offers great checking account options.

The Xtraordinary Checking account has no maintenance fee or minimum balance requirement. This makes it worry-free. The Xtraordinary Checking account also offers a substantial APY at 1.75%. This is another account that allows you to keep all your money with a little yearly boost.

nbkc bank Everything Account

nbkc bank is a financial institution located in the Kansas City metropolitan area. Once again, location is not a problem because nbkc offers all its products and services online. This institution’s defining feature is its checking and savings bundle account, which streamlines the banking process.

The Everything Account allows you to both spend and save money in one account. You are able to set up “virtual piggy banks” and track your savings goals without toggling between multiple accounts. This account also offers a small APY coupled with no monthly maintenance fee or minimum balance requirement.

Heritage Bank eCentive Account

Heritage Bank’s physical locations are located in and around Topeka, Kansas – however, Heritage Bank also offers all products and services online. Heritage Bank boasts the eCentive account, which is used and maintained completely online.

The eCentive Account is a checking account that offers a 1.09% APY. There are no fees associated with this account, but it does require a US$100 minimum deposit requirement. This deposit requirement may be a hurdle for some, but it offers many other benefits that outweigh that first deposit.

Why you should shop around

It may seem time-consuming to shop around for something as simple as a checking account, but it’s necessary. Many banking institutions have different requirements to qualify for their products and services.

Additionally, different checking accounts may require recurring fees. These aspects of banking can be challenging for some individuals, especially during a pandemic. Start with your banking services and look for other tips on money management during a pandemic to stay on top of your financial life.

What to consider when selecting a checking account

Even if you decide against the checking accounts described here, there are several things you need to consider before signing up for a checking account.

First, consider the fees and requirements associated with the checking account. Some fees are recurring and can surprise account owners who are unaware of these requirements.

Second, consider the extra benefits of the checking account. These benefits can include spending perks or discounts at various franchises as well as potential money growth with APYs.

It’s also important to consider the trajectory of the national economy. With the recent changes in the federal administration, there may also be changes in the country’s economy. These changes can and do affect financial institutions.

Remember to consider the full administration – not just the president. The vice president affects the policy and agenda too, so take a look at Kamala Harris and the economy.

Checking accounts and car insurance

Checking accounts can offer benefits outside the world of finances. Some accounts offer discounts on outside purchases or services. One potential discount is on car insurance. Car insurance discounts are more commonly available for those working in the world of finance.

If you find yourself working as an accountant, then you are eligible for discounted rates and additional benefits on car insurance. Check with your current insurance provider or any potential providers about these discounts and see what kind of money you can save.

This article was contributed by Laura Gunn, an auto insurance expert who researches and writes for the car insurance comparison site CarInsuranceComparison.com. Laura is passionate about car owners finding savings without cutting coverage or peace of mind.

Have a story to share? Get in touch at contributors@themilsource.com

Comments ()